Industrials Lead the Charge as Equity Markets Grapple to Sustain Momentum | April 15, 2024

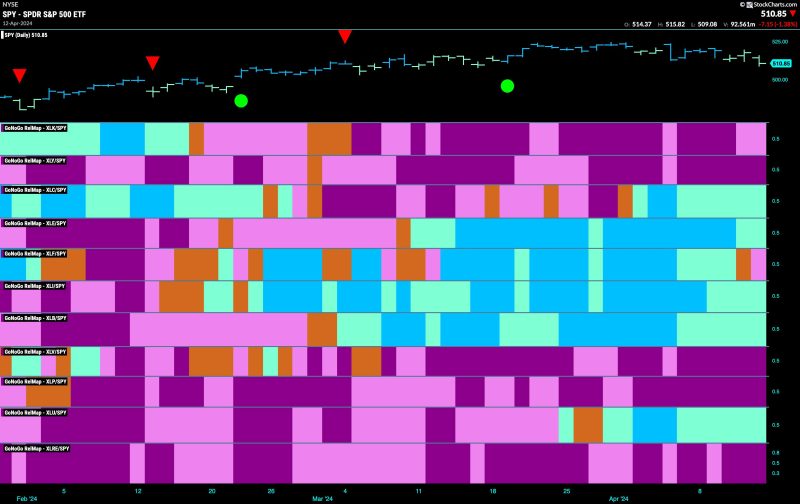

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead – Apr 15, 2024

In the world of finance, the performance of equity markets is a topic that constantly garners attention. With investors seeking to make informed decisions, it is crucial to stay updated on the trends and movements within financial markets. On April 15, 2024, equity markets were experiencing a struggle to maintain the upward momentum that had characterized recent trading sessions. Despite this challenge, the industrial sector appeared poised to take the lead, offering a glimmer of hope to wary investors.

One key aspect that influenced the market dynamics on this day was the ongoing geopolitical tensions. Uncertainty stemming from global events had created a sense of unease among market participants, leading to cautious trading behavior. Investors were closely monitoring the developments in international relations, recognizing the potential impact on market sentiment and economic stability. As a result, the equity markets faced a hurdle in maintaining a consistent upward trajectory.

Amidst this backdrop of uncertainty, the industrial sector emerged as a beacon of strength on April 15. Industrial companies, encompassing a diverse range of businesses such as manufacturing, aerospace, and construction, displayed resilience in the face of market volatility. Investors showed increased interest in industrial stocks, betting on the sector’s ability to navigate challenges and deliver solid returns. The performance of industrial stocks served as a positive indicator amidst the broader market struggles, highlighting the sector’s potential for growth and stability.

Another factor that influenced market dynamics on April 15 was the performance of technology stocks. The technology sector, often considered a bellwether for broader market trends, faced challenges during the trading session. Tech stocks experienced fluctuations as investors assessed the impact of changing consumer preferences, regulatory pressures, and global economic conditions. The performance of technology stocks contributed to the overall volatility in the equity markets, underscoring the interconnected nature of different industry sectors.

As investors navigated the complexities of market dynamics on April 15, the role of macroeconomic indicators and monetary policy decisions cannot be overlooked. Economic data releases, such as GDP growth figures, inflation rates, and employment reports, provided insights into the health of the economy and prospects for future growth. Additionally, central bank announcements about interest rates and monetary stimulus measures influenced investor sentiment and market sentiment, shaping the direction of equity markets.

In conclusion, the trading session on April 15, 2024, encapsulated the nuanced dynamics of equity markets, characterized by struggles to maintain upward momentum amidst geopolitical uncertainties. While challenges persisted, the industrial sector stood out as a potential leader, showcasing resilience and attracting investor interest. Technology stocks added to the volatility, reflecting the evolving landscape of the market. As investors monitored macroeconomic indicators and central bank policies, the performance of equity markets remained a focal point for financial decision-making. Ultimately, staying informed and agile in response to market developments is essential for navigating the complexities of the financial landscape.