The article entitled Are the Financials Sending Us a Major Warning Signal? provides a detailed analysis of the current state of financial markets and examines potential warning signs that could indicate trouble ahead. The author delves into various economic indicators, interest rates, and corporate earnings to gauge the health of the financial sector.

One key point raised in the article is the potential impact of rising interest rates on financial markets. As central banks around the world begin to tighten monetary policy in response to inflationary pressures, there is concern that higher borrowing costs could dampen consumer spending and business investment. This could lead to a slowdown in economic growth and negatively affect corporate profits.

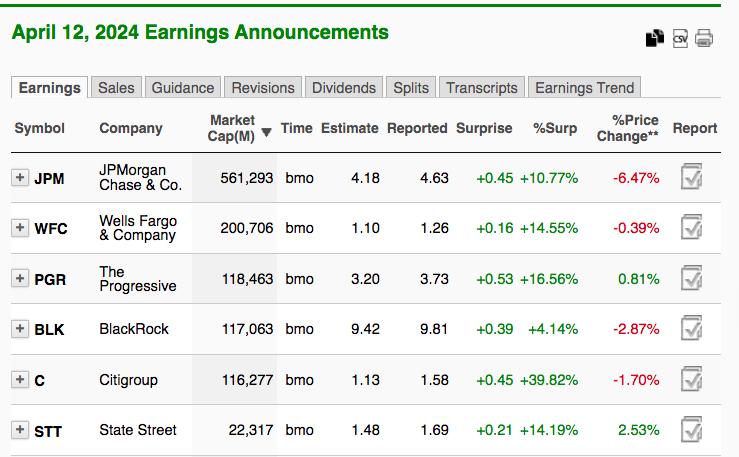

The article also highlights the importance of corporate earnings in driving stock market performance. While many companies have reported strong earnings growth in recent quarters, there are signs that this trend may be losing momentum. Slowing revenue growth and rising costs could weigh on profitability and cause investors to reevaluate their expectations for future earnings.

Additionally, the article points out the potential risks associated with high levels of corporate debt. As interest rates rise, companies with significant debt obligations could face challenges in servicing their loans, potentially leading to defaults and bankruptcies. This could have ripple effects throughout the financial system and pose a systemic risk to the economy.

Overall, the article serves as a timely reminder for investors to remain vigilant and carefully monitor key indicators in the financial markets. By staying informed and proactive, individuals can better navigate the uncertainty and volatility that may lie ahead. As the author aptly concludes, Taking precautionary measures and staying prepared for any potential downturn is essential in today’s rapidly evolving financial landscape.