Surprising Rise: Technology Stocks Outside Mega Caps Show Improvement, Says RRG

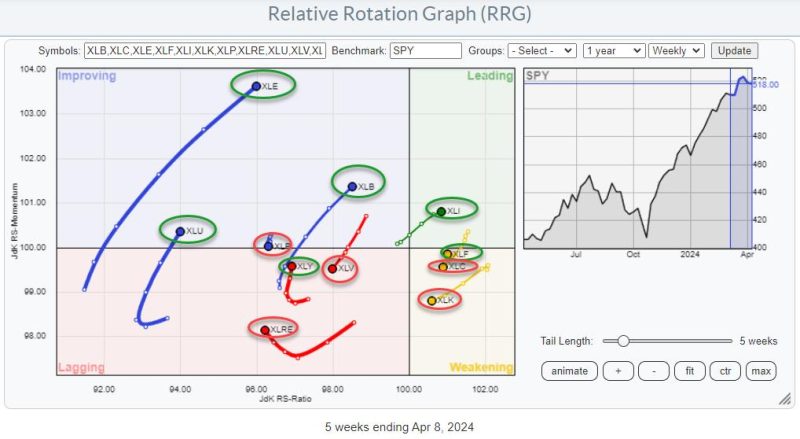

In a recent article published on Godzilla Newz, the Relative Rotation Graph (RRG) analysis has indicated that non-mega-cap technology stocks are showing signs of improvement in the market. This analysis provides valuable insights for investors looking to diversify their portfolios beyond the large-cap tech giants.

The RRG analysis, which tracks the relative strength and momentum of different stocks or sectors, is a useful tool for identifying trends and potential investment opportunities. In this case, the RRG suggests that non-mega-cap technology stocks are moving towards the leading quadrant, indicating that they are gaining strength relative to the broader market.

One of the key benefits of investing in non-mega-cap technology stocks is the potential for higher growth rates compared to their larger counterparts. These companies often operate in niche markets or emerging technologies, allowing them to capture market share and expand rapidly. By focusing on non-mega-cap tech stocks, investors can tap into this growth potential and diversify their portfolios beyond the well-known tech giants.

Additionally, non-mega-cap technology stocks may offer attractive valuations compared to larger companies. As market dynamics shift and investor sentiment changes, smaller tech companies with strong fundamentals and growth prospects can become undervalued. This presents an opportunity for savvy investors to take advantage of mispricings in the market and potentially generate higher returns.

Moreover, investing in non-mega-cap technology stocks can also enhance portfolio diversification. By including a mix of companies across different market capitalizations and sectors, investors can reduce risk and improve overall portfolio performance. Non-mega-cap tech stocks can provide exposure to different areas of the technology sector, such as cloud computing, cybersecurity, and software development, which may not be fully represented in mega-cap tech stocks.

However, it’s essential for investors to conduct thorough research and due diligence before investing in non-mega-cap technology stocks. These companies are often more volatile and carry higher risks compared to established large-cap tech firms. It’s crucial to assess factors such as business models, competitive advantages, management teams, and financial health to make informed investment decisions.

In conclusion, the RRG analysis highlighting the improving performance of non-mega-cap technology stocks presents an intriguing opportunity for investors seeking growth and diversification in their portfolios. By considering these smaller tech companies alongside the giants of the industry, investors can potentially capitalize on emerging trends, undervalued stocks, and enhanced portfolio diversification. It’s essential to approach investing in non-mega-cap tech stocks with caution and thorough research to maximize returns and manage risks effectively in the dynamic tech sector.