The recent trends in the financial markets are indicative of a secular bull market that continues to gain momentum, albeit with a major rotation in key sectors. It is essential for investors to understand these shifts and adjust their portfolios accordingly to maximize returns and mitigate risk.

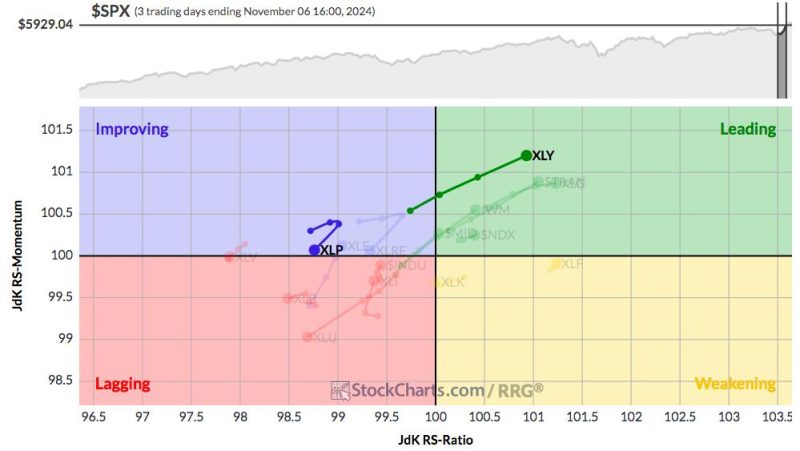

One of the significant changes in market dynamics is the rotation from growth stocks to value stocks. Growth stocks, which had been the primary drivers of market performance in recent years, have started to underperform as investors pivot towards undervalued companies with strong fundamentals. This rotation indicates a broader market sentiment favoring stability and steady returns over high-growth potential.

Simultaneously, sectors such as technology and healthcare, which had been market leaders during the pandemic, are now facing headwinds as investors shift focus towards sectors that stand to benefit from the economic recovery. This shift is driven by optimism surrounding the reopening of economies, increasing consumer spending, and infrastructure stimulus initiatives.

Another notable trend is the rise of ESG (Environmental, Social, and Governance) investing. Investors are increasingly considering sustainability criteria alongside financial performance when making investment decisions. This shift reflects a broader societal awareness of the impacts of climate change and social issues, prompting companies to prioritize responsible practices to attract and retain investor interest.

Cryptocurrencies and digital assets have also emerged as significant players in the financial markets, attracting a growing number of retail and institutional investors. The volatile nature of cryptocurrencies presents both opportunities and risks for investors, requiring a cautious approach to incorporating these assets into diversified portfolios.

Furthermore, geopolitical tensions, inflation concerns, and central bank policies continue to influence market sentiment and asset prices. Investors must remain vigilant and adaptable in navigating these uncertainties to safeguard their portfolios and capitalize on emerging opportunities.

Diversification remains a key strategy for investors looking to weather market fluctuations and achieve long-term financial goals. By spreading investments across various asset classes and sectors, investors can reduce risk exposure and enhance overall portfolio resilience.

In conclusion, the secular bull market is characterized by ongoing shifts and rotations in market dynamics, signaling the need for investors to stay informed, agile, and diversified in their investment approaches. By understanding these trends and adjusting their portfolios accordingly, investors can position themselves to capitalize on emerging opportunities and navigate potential challenges in the ever-evolving financial landscape.