Riding the Wave: Equities Stay on the Move and Embrace the Energy Sector

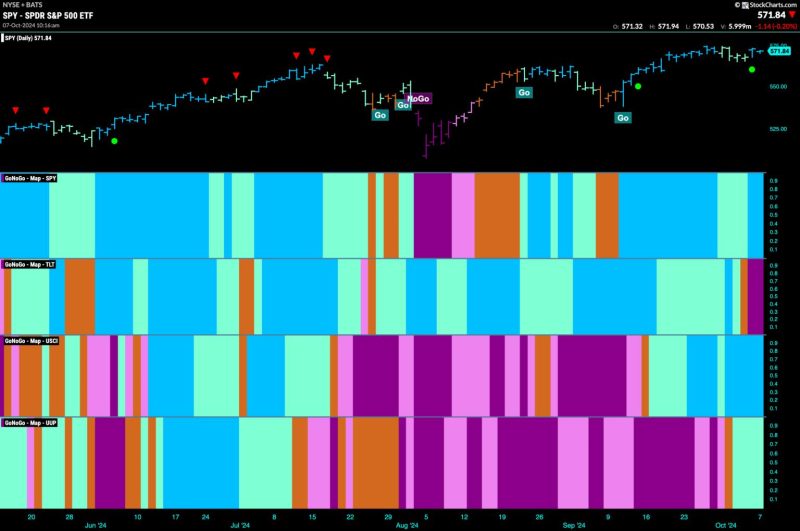

Equities Remain in Go Trend and Lean into Energy

In a notable shift of market dynamics, equities have continued to thrive in the Go trend, showcasing robust performances across various sectors. A key area where investors are currently leaning into is the energy sector, driven by a confluence of factors that have positioned this industry as a promising investment opportunity in the current market landscape.

The energy sector has experienced a resurgence in interest, propelled by several developments that have reshaped the sector’s outlook. One of the primary drivers behind this renewed focus is the escalating global demand for energy resources. As economies recover from the impacts of the pandemic and resume operations at full capacity, the need for energy sources has surged, creating a conducive environment for energy companies to thrive.

Moreover, the energy sector has witnessed a notable shift towards sustainable practices and renewable energy sources. Companies within the sector are increasingly investing in clean energy initiatives, reflecting a growing awareness of the importance of environmental sustainability. This transition not only aligns with broader societal goals but also presents attractive investment opportunities for those looking to capitalize on the shift towards renewable energy solutions.

Another factor contributing to the positive momentum in the energy sector is the rebound in oil prices. As global demand for oil gradually rebounds, supported by economic recoveries and increased industrial activities, oil prices have shown strength, providing a favorable backdrop for energy companies. This resurgence in oil prices has bolstered the financial outlook of energy companies, enabling them to benefit from improved profitability and robust cash flows.

Furthermore, technological advancements and innovation have played a pivotal role in enhancing the efficiency and productivity of energy companies. The integration of digital technologies, data analytics, and automation has revolutionized operations within the energy sector, enabling companies to optimize their processes, reduce costs, and drive sustainable growth. By leveraging these innovations, energy companies are better positioned to adapt to evolving market dynamics and capitalize on emerging opportunities in the sector.

Investors are increasingly recognizing the potential of the energy sector as a lucrative investment avenue within the current market environment. The sector’s resilience, coupled with the favorable macroeconomic trends and transformative developments shaping the industry, has bolstered investor confidence and attracted capital inflows into energy-related assets. As equities continue to flourish in the Go trend, the energy sector stands out as a compelling investment opportunity that offers both growth potential and sustainability benefits.

In conclusion, the energy sector’s resurgence and the broader momentum in equities underscore the dynamic nature of the current market environment. By leaning into the energy sector and capitalizing on the positive developments shaping the industry, investors can position themselves to benefit from the sector’s growth prospects and contribute to sustainable investment practices. As equities remain in the Go trend, investors are encouraged to explore opportunities within the energy sector and leverage the sector’s potential for long-term value creation.