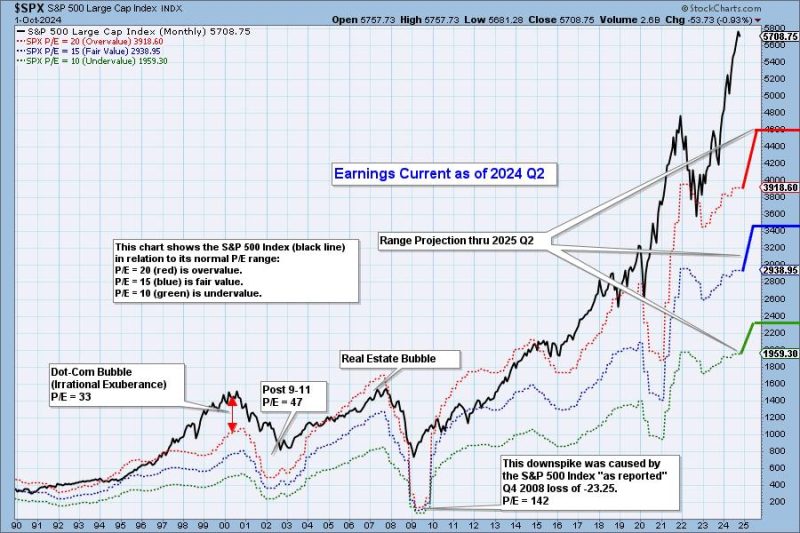

The article provided in the link discusses the overvaluation of the market as highlighted by the 2024 Q2 earnings report. In the following sections, we will delve deeper into the concept of market overvaluation, its implications, and potential strategies for investors in such a market scenario.

Understanding Market Overvaluation

Market overvaluation occurs when asset prices are higher than their intrinsic value. This situation often arises due to investor exuberance, excessive speculation, or loose monetary policies. The 2024 Q2 earnings report serves as a barometer to gauge the health of the market and assess whether stocks are priced in line with their underlying fundamentals.

Market Implications

An overvalued market poses risks to investors as it increases the likelihood of a market correction or crash. When asset prices detach from their intrinsic value, there is a higher probability of a sharp downturn that can erode investors’ wealth. Moreover, an overvalued market may deter new investors from entering, as the risk of losses outweighs the potential returns.

Investor Strategies

In light of a highly overvalued market, investors are advised to exercise caution and adopt prudent strategies to safeguard their investments. Diversification is key in mitigating risks associated with market fluctuations. By spreading investments across different asset classes and sectors, investors can reduce their exposure to potential downturns in a specific market segment.

Furthermore, investors may consider scaling back on risky assets and reallocating funds to more defensive sectors that have historically shown resilience during market downturns. Additionally, implementing a disciplined approach to investing, adhering to a long-term investment horizon, and avoiding emotional decision-making can help investors navigate an overvalued market environment successfully.

Conclusion

In conclusion, the 2024 Q2 earnings report serves as a reminder of the market’s vulnerability to overvaluation. Investors need to stay vigilant, conduct thorough research, and exercise caution to navigate through potentially turbulent market conditions. By adopting a diversified and disciplined investment approach, investors can mitigate the risks associated with an overvalued market and position themselves for long-term success in their investment journey.