Are the Stock Markets Really Healthy? Let’s Play Some Economic Go Fish!

Equities Say Go Fish: How Healthy Are the Markets?

The landscape of the financial markets is constantly evolving, responding to a variety of factors such as economic data, geopolitical events, and market sentiment. Investors closely analyze these indicators to gauge the health of the markets and make informed decisions about their investments. One key area of focus for many investors is the equities market, which provides a snapshot of the overall health of the economy and investor confidence. In this article, we will explore the current state of the equities market and assess its health based on various metrics and indicators.

Market Performance and Volatility

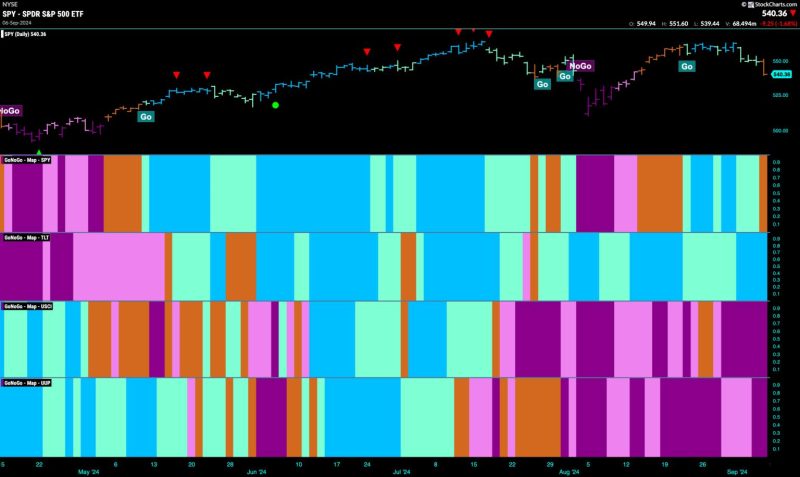

The performance of the equities market is often measured by key stock indices such as the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite Index. These indices track the performance of a basket of large-cap stocks and are used as barometers of the overall market health. In recent years, stock indices have reached record highs, driven by factors such as robust corporate earnings, low interest rates, and fiscal stimulus measures. However, the markets can also experience periods of volatility and corrections, which can impact investor sentiment and market stability.

Market Valuations and Fundamentals

Another critical factor in assessing the health of the equities market is market valuations. Valuation metrics such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield can provide insights into whether stocks are overvalued or undervalued relative to their fundamentals. High valuations may indicate that stocks are expensive and could be vulnerable to a market pullback, while low valuations may present buying opportunities for value investors.

Market Sentiment and Investor Behavior

Market sentiment plays a significant role in driving the direction of the equities market. Investor psychology, risk appetite, and behavioral biases can influence market trends and create opportunities for contrarian investors. Sentiment indicators such as the VIX (Volatility Index), put/call ratio, and investor surveys can provide clues about investor sentiment and market sentiment extremes. Additionally, factors such as market breadth, sector rotation, and institutional buying can offer insights into investor behavior and market dynamics.

Market Risks and Uncertainties

While the equities market can exhibit strength and resilience, it is also exposed to various risks and uncertainties that can disrupt market stability. Geopolitical events, economic data releases, corporate earnings reports, and central bank policy decisions can all impact market performance and investor confidence. Moreover, external factors such as inflation, interest rates, and global trade tensions can create headwinds for the equities market and lead to increased volatility.

In conclusion, assessing the health of the equities market requires a comprehensive analysis of market performance, valuations, sentiment, and risks. By monitoring key indicators and staying informed about market developments, investors can make informed decisions about their investments and navigate the dynamic financial landscape. Ultimately, staying vigilant and adaptable in response to changing market conditions is essential for achieving long-term investment success in the equities market.