Breakout Alert: NIFTY Signals Potential Shift in Uptrend – Proceed with Caution

In the ever-evolving world of finance and investments, staying ahead of market trends is crucial for investors looking to make informed decisions. Recently, the global financial landscape has seen considerable fluctuations, with indices such as Nifty exhibiting early signs of potential disruptions to their uptrend. In this article, we delve into the implications of these developments and provide insights on navigating the uncertain waters of the financial markets.

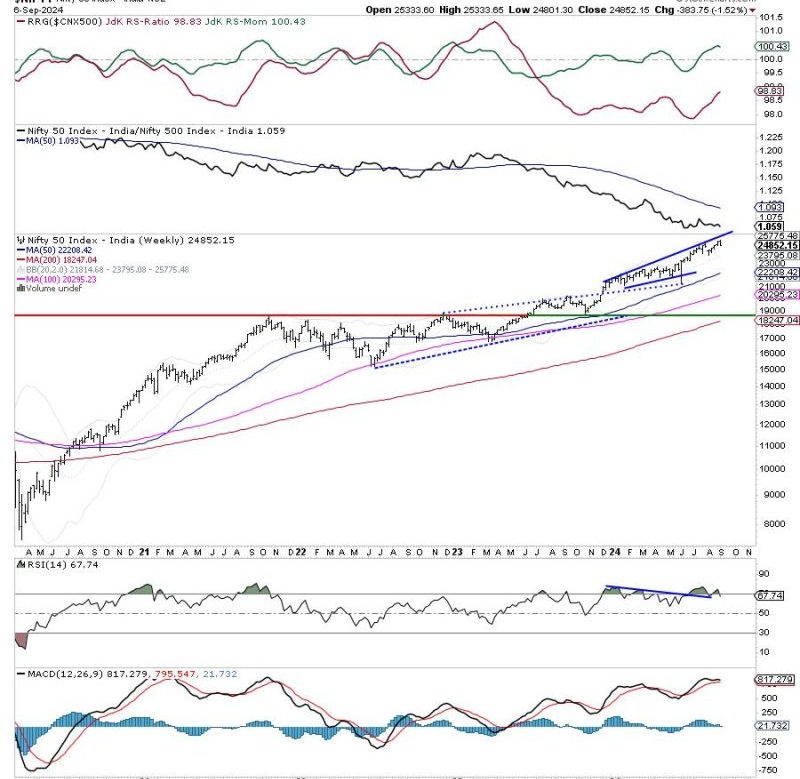

The Nifty index, a benchmark index for the Indian equity market, has been on a steady uptrend for a period of time. However, the emergence of early signs indicating a likely disruption of this trend has raised concerns among investors. Market analysts have noted specific indicators, such as technical patterns and trading volumes, that point towards a potential shift in market sentiment.

One of the key indicators signaling a possible disruption of the uptrend is the formation of bearish reversal patterns on the price charts. These patterns, such as head and shoulders formations or double tops, suggest a shift in momentum from bullish to bearish. Investors who closely monitor these technical signals may consider adjusting their investment strategies to mitigate potential risks associated with a market downturn.

Furthermore, fluctuations in trading volumes can also offer valuable insights into market dynamics. A significant decrease in trading volumes during an uptrend could indicate waning investor enthusiasm and a weakening market foundation. In such scenarios, investors may opt to exercise caution and reassess their portfolio allocations to safeguard their investments against potential downside risks.

In addition to technical indicators, macroeconomic factors play a crucial role in shaping market trends. Events such as policy changes, geopolitical tensions, or economic data releases can influence investor sentiment and trigger market volatility. As uncertainties loom over the global economy, investors should remain vigilant and closely monitor developments that could impact their investment portfolios.

While the prospect of a potential disruption to the uptrend may instill unease among investors, it also presents opportunities for astute decision-making. By staying informed, diversifying their portfolios, and adopting risk management strategies, investors can position themselves to navigate market uncertainties effectively. Maintaining a disciplined approach to investing, conducting thorough research, and seeking professional advice can help investors make sound decisions even in volatile market conditions.

In conclusion, the early signs of a likely disruption of the uptrend in the Nifty index serve as a reminder of the dynamic nature of financial markets. By staying proactive, adaptive, and well-informed, investors can mitigate risks and capitalize on opportunities that arise amidst market uncertainties. As the financial landscape continues to evolve, prudent risk management and strategic planning remain essential components of successful investing.