Crash Course: Navigating the Stock Market Selloff to Protect Your Portfolio

Broad-Based Stock Market Selloff: How to Position Your Portfolio

Assess Your Risk Tolerance and Investment Goals

The first step in positioning your portfolio during a broad-based stock market selloff is to assess your risk tolerance and investment goals. Understanding how much risk you are willing to take and what you are aiming to achieve with your investments will help guide your decision-making process during volatile market conditions.

If you have a low risk tolerance and are seeking long-term growth, you may want to focus on more conservative investments such as bonds or dividend-paying stocks. On the other hand, if you have a higher risk tolerance and are looking for higher returns, you may be more inclined to invest in growth stocks or other riskier assets.

Diversify Your Portfolio

Diversification is key to managing risk in your investment portfolio, especially during a broad-based stock market selloff. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of any one investment performing poorly.

Consider including a mix of stocks, bonds, real estate, and other assets in your portfolio to help weather the storm of a market downturn. Additionally, diversifying within each asset class by investing in a variety of companies can further protect your portfolio from significant losses.

Opportunities in Market Selloffs

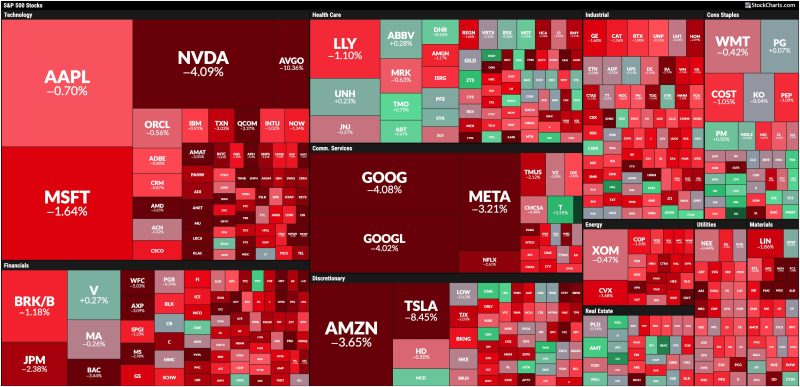

While stock market selloffs can be unsettling, they also present opportunities for savvy investors. During a market downturn, many high-quality stocks may be trading at discounted prices, providing an opportunity to buy them at a bargain.

Consider keeping some cash reserves available to take advantage of buying opportunities that may arise during a selloff. Look for companies with strong fundamentals, solid balance sheets, and a history of weathering market downturns.

Review and Rebalance Your Portfolio Regularly

In a volatile market environment, it is important to regularly review and rebalance your investment portfolio. Reassess your risk tolerance, investment goals, and asset allocation to ensure that your portfolio remains aligned with your objectives.

During a broad-based stock market selloff, some of your investments may have lost value while others may have held up better than expected. Rebalancing your portfolio can help you realign your asset allocation, trimming overweight positions and adding to underperforming investments.

Seek Professional Advice

If you are uncertain about how to position your portfolio during a stock market selloff, consider seeking advice from a professional financial advisor. An experienced advisor can provide personalized guidance based on your individual financial situation, risk tolerance, and investment goals.

By working with a professional, you can gain valuable insight into how to navigate volatile market conditions and position your portfolio for long-term success.

In conclusion, a broad-based stock market selloff can be a challenging time for investors, but it also presents opportunities for those who are prepared. By assessing your risk tolerance, diversifying your portfolio, taking advantage of buying opportunities, and seeking professional advice, you can position your portfolio to weather the storm and potentially benefit from market downturns.