Moving Up: NIFTY’s Uptrend Holds Strong Amid Defensive Market Signals

The week ahead: Uptrend Stays Intact for Nifty as RRG Shows Distinctly Defensive Setup

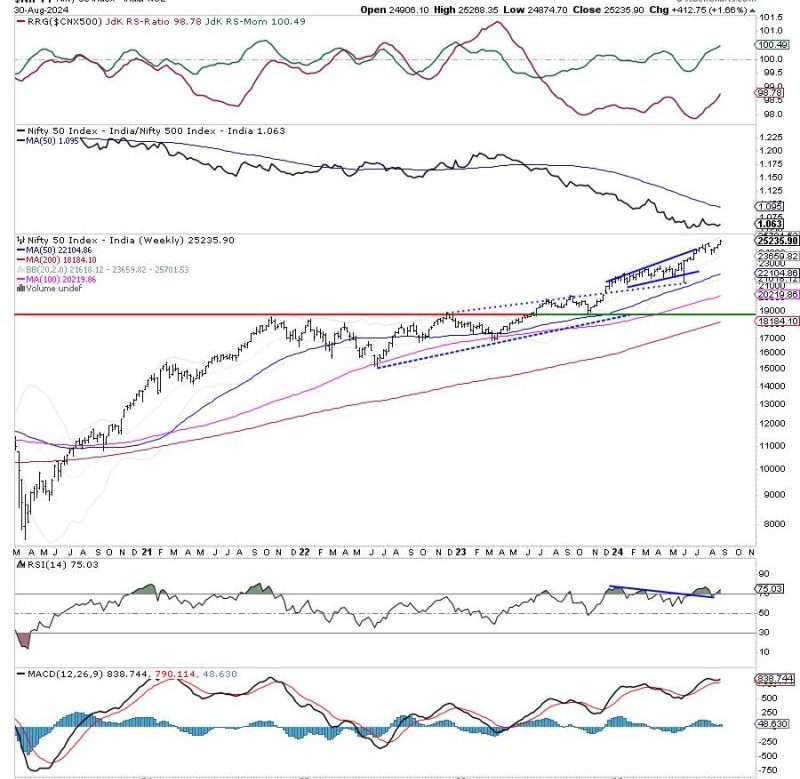

Technical Analysis: Nifty 50 Index

The Nifty 50 index has continued to exhibit strength, with the uptrend remaining intact despite some recent volatility. As per the Relative Rotation Graph (RRG), there is a distinctly defensive setup in the market. This suggests that rotation is turning towards sectors that are relatively more defensive in nature, indicating a shift in market sentiment towards a more cautious outlook.

Key Levels to Watch

For the upcoming week, key levels to watch in the Nifty 50 index include support at 15,600 and resistance at 15,900. A break below the support level could signal a potential trend reversal, while a breach of the resistance level could lead to further upside momentum.

Sector Analysis

The RRG analysis reveals that defensive sectors like IT, pharma, and FMCG are currently displaying relative strength, indicating that investors may be rotating towards these safer assets. On the other hand, sectors like banking, auto, and metal are exhibiting weaker relative strength and are positioned in the lagging quadrant on the RRG chart.

Market Outlook

Overall, the market remains in an uptrend, supported by positive economic data and corporate earnings. However, the defensive setup on the RRG suggests that investors are becoming more cautious and are rotating towards defensive sectors amid concerns over rising inflation and global uncertainties.

Trading Strategies

In light of the defensive setup on the RRG, traders and investors may consider focusing on defensive sectors for potential opportunities. Stocks in sectors like IT, pharma, and FMCG could offer relative strength and stability in the current market environment.

Risk Management

While the uptrend in the Nifty 50 index remains intact, it is important for traders to manage risk effectively and be prepared for potential shifts in market sentiment. Setting stop-loss levels and diversifying across different sectors can help mitigate risks and protect capital in volatile market conditions.

Conclusion

In conclusion, the uptrend in the Nifty 50 index continues to hold, but the market is displaying a distinctly defensive setup as per the RRG analysis. Investors should remain vigilant and adjust their trading strategies accordingly to navigate the evolving market dynamics and potential risks. By closely monitoring key levels, sectors, and market sentiment, traders can make informed decisions and capitalize on emerging opportunities in the week ahead.