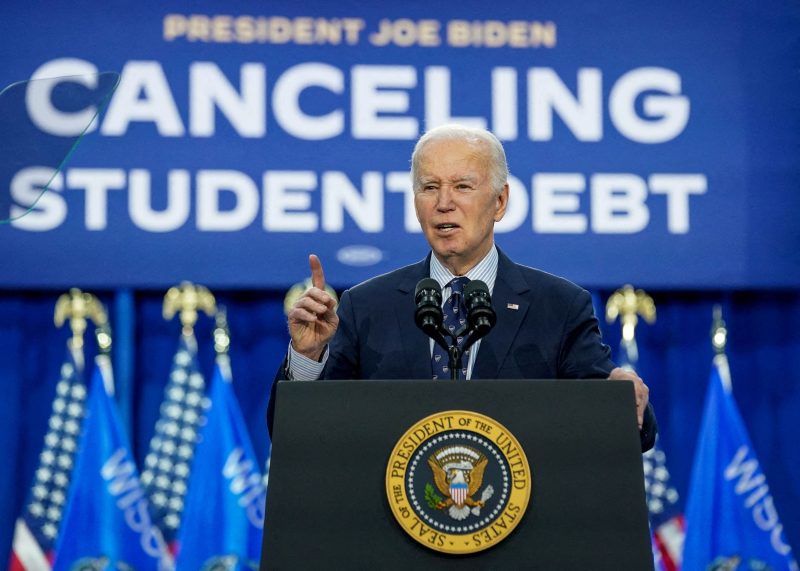

Breaking News: Supreme Court Blocks Biden’s Student Loan Repayment Plan – Temporarily!

In a recent development that has significant implications for student loan borrowers, the Supreme Court chose not to allow President Biden’s proposed student loan repayment plan to proceed at this time. This decision comes amidst a legal battle over the President’s authority to extend a pandemic-era student loan relief program, which was set to expire in September 2021.

The case revolves around the question of whether President Biden had the power to unilaterally extend the student loan payment pause without seeking the approval of Congress. The Biden administration argued that the extension was necessary to provide relief to millions of Americans impacted by the ongoing economic challenges caused by the COVID-19 pandemic.

However, a group of 17 states led by Missouri filed a lawsuit challenging the extension, arguing that the administration’s actions exceeded the President’s authority under the law. The Supreme Court’s decision not to allow Biden’s repayment plan to move forward temporarily upholds a lower court ruling that blocked the extension of the student loan payment pause.

The implications of this decision are far-reaching. Student loan borrowers who were anticipating further relief under the extended payment pause will now have to resume making payments on their loans. This could pose a significant financial burden on many borrowers, especially those who are still facing economic hardship as a result of the pandemic.

The legal battle over the student loan repayment plan reflects broader debates about the balance of power between the executive and legislative branches of government. The question of whether the President has the authority to unilaterally implement policies such as the student loan payment pause without Congressional approval remains a contentious issue.

While the Supreme Court’s decision is a setback for the Biden administration’s student loan relief efforts, it is not the final word on the matter. The case will likely continue to play out in the lower courts, and the administration may seek alternative ways to provide relief to student loan borrowers in the future.

In the meantime, the debate over student loan repayment and relief measures will continue to be a pressing issue for policymakers, lawmakers, and borrowers alike. Finding a balance between addressing the financial challenges faced by student loan borrowers and respecting the boundaries of executive authority will remain a key challenge in the ongoing discussion surrounding student loan policy in the United States.