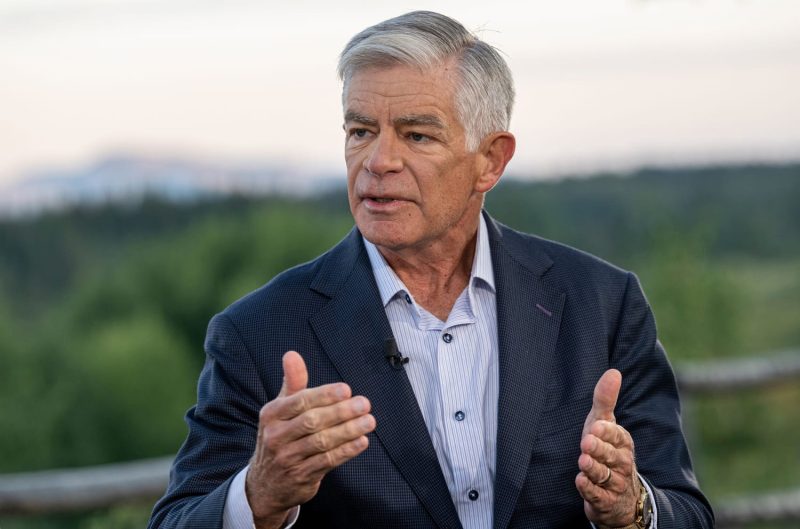

In a recent speech at the Global Interdependence Center in London, Philadelphia Fed President Patrick Harker made a case for an interest rate cut in September. Harker’s advocacy for reducing interest rates comes amid growing concerns about slowing global economic growth and escalating trade tensions between the US and China. As an influential member of the Federal Reserve’s policymaking committee, Harker’s views carry weight within the financial markets and could shape the central bank’s monetary policy decisions in the coming months.

One of the key arguments put forth by Harker in favor of an interest rate cut is the impact of ongoing trade uncertainties on business confidence and investment. The trade war between the US and China has created a climate of uncertainty, leading businesses to delay or scale back their investment plans. Harker contends that a rate cut could help offset some of the negative effects of the trade dispute by lowering borrowing costs for businesses and consumers, thereby stimulating economic activity.

Moreover, Harker emphasized the importance of being proactive in addressing economic risks rather than waiting for them to materialize. With inflation running below the Fed’s target of 2%, Harker believes that the central bank has room to maneuver on monetary policy in order to support economic growth and prevent a downturn. By cutting interest rates preemptively, the Fed could help bolster confidence and encourage spending, thereby mitigating the potential impacts of a global slowdown.

However, Harker’s advocacy for an interest rate cut is not without its detractors. Some critics argue that lowering rates could fuel financial market excesses and asset bubbles, rather than spurring real economic growth. Additionally, concerns have been raised about the effectiveness of monetary policy in the current environment, given the limited scope for further rate cuts and the diminishing returns of unconventional policy measures.

In conclusion, Philadelphia Fed President Patrick Harker’s call for an interest rate cut in September reflects the challenging economic environment facing policymakers. As uncertainties surrounding trade tensions and global growth persist, central banks are under increasing pressure to take action to support their respective economies. Harker’s arguments for a preemptive rate cut are aimed at providing a cushion against downside risks and bolstering confidence in the face of a shifting economic landscape. The upcoming FOMC meeting in September will be closely watched to see whether Harker’s views gain traction and influence the Fed’s policy decisions.