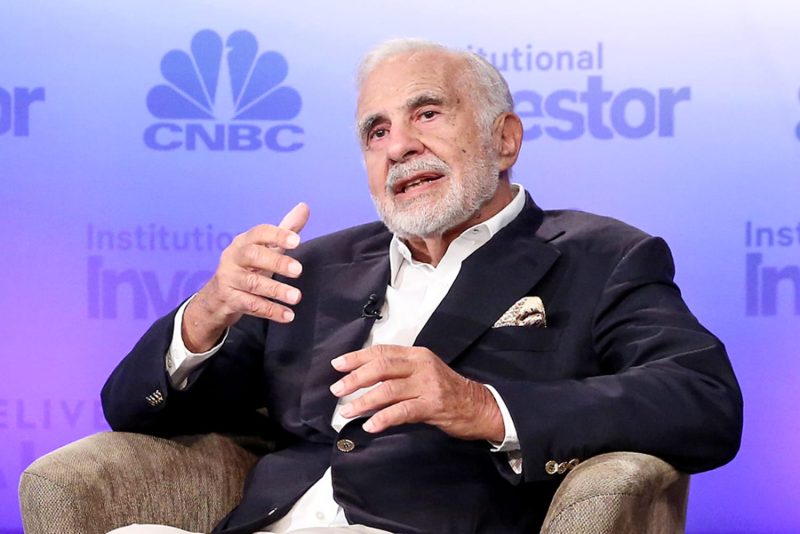

Carl Icahn Busted by SEC for Concealing Billions in Stock Pledges

In a shocking turn of events, the Securities and Exchange Commission (SEC) has charged billionaire investor Carl Icahn with allegedly hiding billions of dollars’ worth of stock pledges from investors and violating securities regulations. This development has made waves in the financial world, given Icahn’s reputation as a prominent figure in the investment community.

The SEC’s allegations stem from Icahn’s failure to disclose his stock holdings as collateral for margin loans, which has raised concerns about potential conflicts of interest and transparency issues. The SEC contends that Icahn used these undisclosed holdings to secure loans from various financial institutions, thereby creating a situation that could leave investors at a disadvantage.

Icahn, known for his activist investing style and bold strategies, has been a notable figure on Wall Street for decades. His approach of taking significant stakes in companies to push for changes and drive shareholder value has earned him both admirers and critics. However, the recent charges by the SEC have cast a shadow over his legacy and raised questions about the ethical implications of his actions.

The case against Icahn highlights the importance of transparency and disclosure in the financial industry. Investors rely on accurate and timely information to make informed decisions about their investments, and any attempts to conceal material facts can undermine market integrity and erode trust. The SEC’s enforcement action serves as a reminder that no one, regardless of their stature or track record, is above the law when it comes to securities regulations.

The impact of the charges against Icahn extends beyond the individual case to the broader investment community. It underscores the need for heightened vigilance and scrutiny in monitoring financial activities and ensuring compliance with regulations. Investors and market participants must remain vigilant and hold themselves and others accountable to maintain the integrity and credibility of the financial markets.

As the case against Carl Icahn unfolds, the financial world watches closely to see how it will shape the future of regulatory enforcement and accountability in the investment industry. The outcome of this legal battle will not only impact Icahn’s reputation but also set a precedent for how regulatory bodies address similar cases in the future. In the ever-evolving landscape of finance, adherence to compliance and ethical standards remains paramount to uphold investor trust and market stability.