Stay Ahead: NIFTY’s Tentative Stance Amid Defensive Shift – Master These Key Levels!

The week ahead for the Nifty index is expected to be on a tentative note as a defensive setup seems to be developing. Investors and traders need to be aware of the key levels in order to navigate through these uncertain times effectively.

One of the critical levels to watch out for is the support level at 15,650. This level has served as a crucial pivot point in the past and is likely to continue playing a significant role in the upcoming sessions. A breach below this level could pave the way for further downside, signaling increased bearish sentiment in the market.

On the upside, the resistance level at 15,850 should be closely monitored. A breakout above this level could motivate buyers to push the index higher, potentially targeting new highs. However, a sustained move above this resistance level would be necessary to confirm a bullish momentum.

The 15,750 level presents another important range to watch, as it could act as a consolidation zone and provide insights into market sentiment. A decisive move above or below this level could offer clues about the direction in which the market is likely to move next.

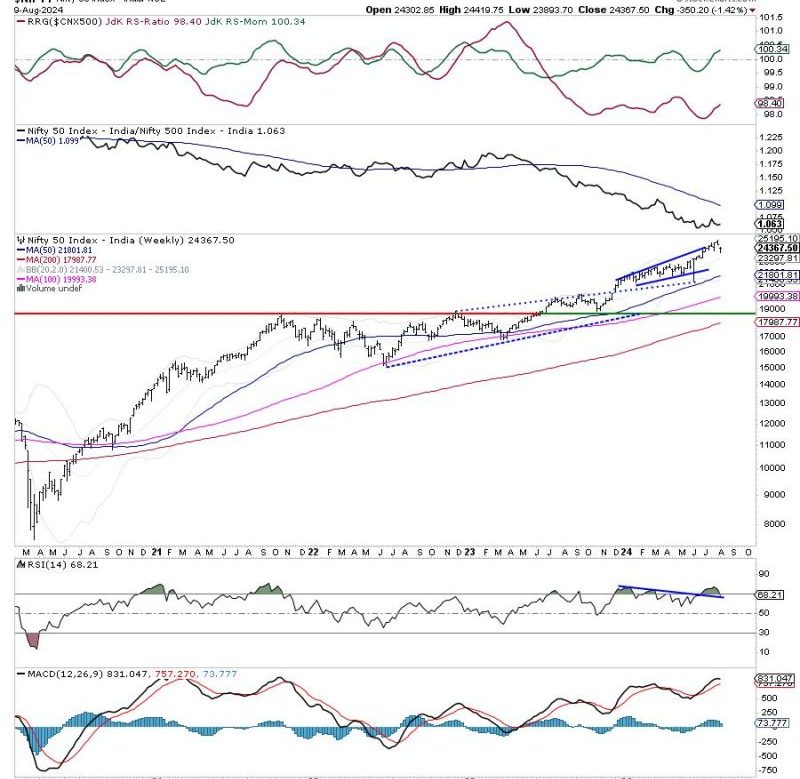

Technical indicators such as the Relative Strength Index (RSI) and Moving Averages (MA) can also provide valuable signals to traders. The RSI could offer insights into whether the market is overbought or oversold, helping traders to anticipate potential reversals. Similarly, the MA can help identify trends and potential areas of support and resistance.

In conclusion, staying attuned to the key levels and technical indicators can assist traders and investors in navigating the Nifty index effectively during the upcoming week. By monitoring these levels closely and interpreting the signals provided by technical indicators, market participants can make informed decisions and adjust their strategies accordingly to capitalize on potential opportunities in the market.