Shocking Revelation: The Federal Reserve’s Nightmare Creation – Are We Merely Puppets?

The Federal Reserve’s actions have long been scrutinized and debated by economic analysts, policymakers, and the general public. The recent decisions made by the Fed have led to a significant impact on the financial markets and the economy as a whole. By delving into the events following the Fed’s recent actions, we can better understand the potential consequences of their policies.

To begin with, the Fed’s decision to implement a loose monetary policy has caused a surge in inflation rates, a point that has sparked concerns among experts and market participants. Inflation erodes the purchasing power of consumers, leading to higher costs of living and reduced savings. The ripple effects of inflation are felt across various sectors, such as housing, food, and energy, ultimately affecting the overall economic stability.

Moreover, the Fed’s dovish stance on interest rates has further exacerbated the inflationary pressures. By keeping interest rates near zero, the Fed aims to stimulate economic growth and boost employment rates. However, this accommodative policy has unintended consequences, as low-interest rates incentivize excessive borrowing and speculative activities, potentially leading to financial imbalances and market distortions.

Additionally, the Fed’s massive bond-buying program, known as quantitative easing, has inflated asset prices and led to a surge in corporate debt levels. While intended to provide liquidity support to financial markets during crises, quantitative easing has long-term implications, creating a debt-fueled asset bubble that could burst in the future, triggering a financial crisis.

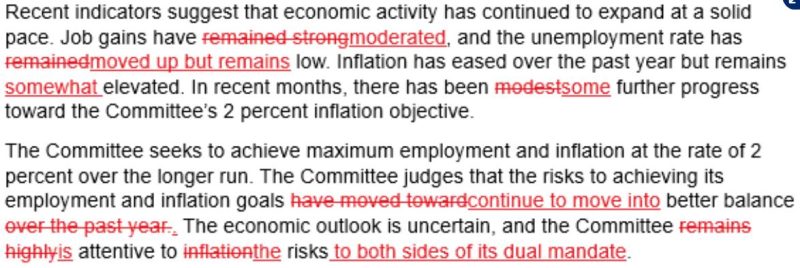

Furthermore, the Fed’s opaque communication strategies and unpredictable policy shifts have added to the uncertainty surrounding the markets. Investors crave predictability and stability to make informed decisions, but the flip-flopping nature of the Fed’s statements has increased market volatility and risk aversion.

Overall, the Fed’s actions have inadvertently created a financial environment fraught with risks and uncertainties. As the puppet master behind the scenes, the Fed wields immense power over the economy, but its decisions can have unintended consequences that reverberate throughout the financial system. It is crucial for policymakers and regulators to closely monitor the Fed’s actions and their implications to mitigate potential risks and ensure long-term economic stability.