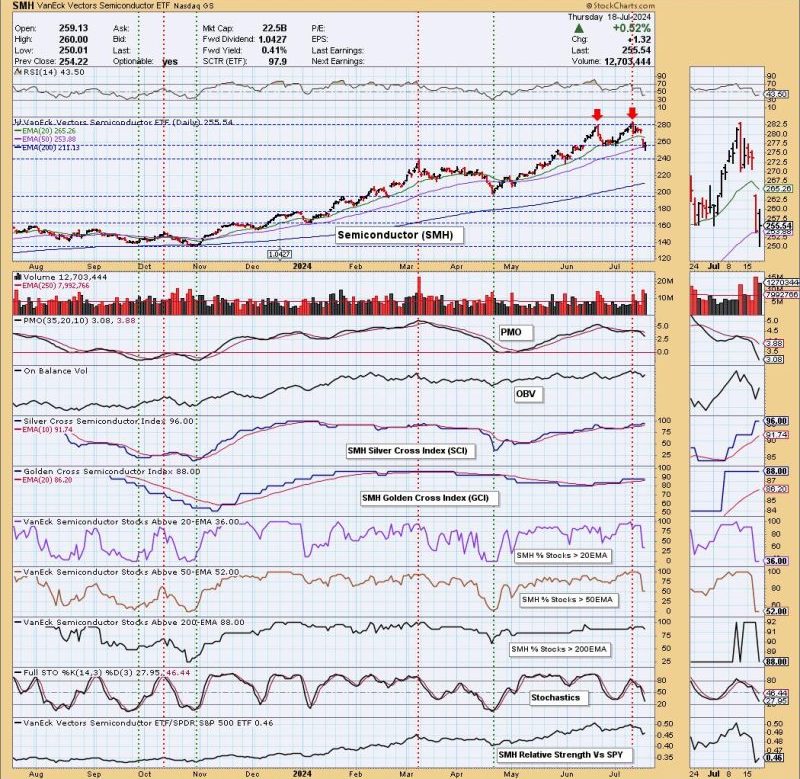

The article Double Top on Semiconductors (SMH) discloses potentially significant technical analysis on the iShares ETF for semiconductors (SMH). This analysis focuses on a double top chart pattern formation that suggests a reversal of the current bullish trend in the ETF. Technical analysts and traders often use chart patterns to predict future price movements based on historical price data.

A double top pattern, as observed in the SMH chart, is a bearish reversal pattern that forms after an extended upward trend. It consists of two peaks at approximately the same price level, separated by a trough or neckline. The pattern is complete when the price breaks below the neckline, signaling a possible change in trend from bullish to bearish. In the case of SMH, the article suggests that the ETF may be at a critical juncture where a trend reversal could occur.

The article also points out that the Relative Strength Index (RSI) for SMH is currently near overbought levels, indicating a potential decrease in buying momentum. When combined with the double top pattern, this RSI reading adds to the bearish case for the ETF. Overbought conditions on the RSI often precede price corrections or reversals.

Traders and investors who closely follow technical analysis may view the formation of a double top pattern and the high RSI reading on SMH as important signals to consider when making trading decisions. Some may interpret these signals as an opportunity to sell or short the ETF in anticipation of a price decline. However, it’s essential to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies.

In conclusion, the analysis provided in the article highlights a potential double top pattern on the semiconductors ETF SMH, along with an overbought RSI reading. These signals suggest a possible trend reversal from bullish to bearish in the near future. Traders and investors should exercise caution and consider all available information before making any trading decisions based on technical analysis alone.