Navigating the Week: Watch Out for Market Breadth and Nifty’s Potential Retracement

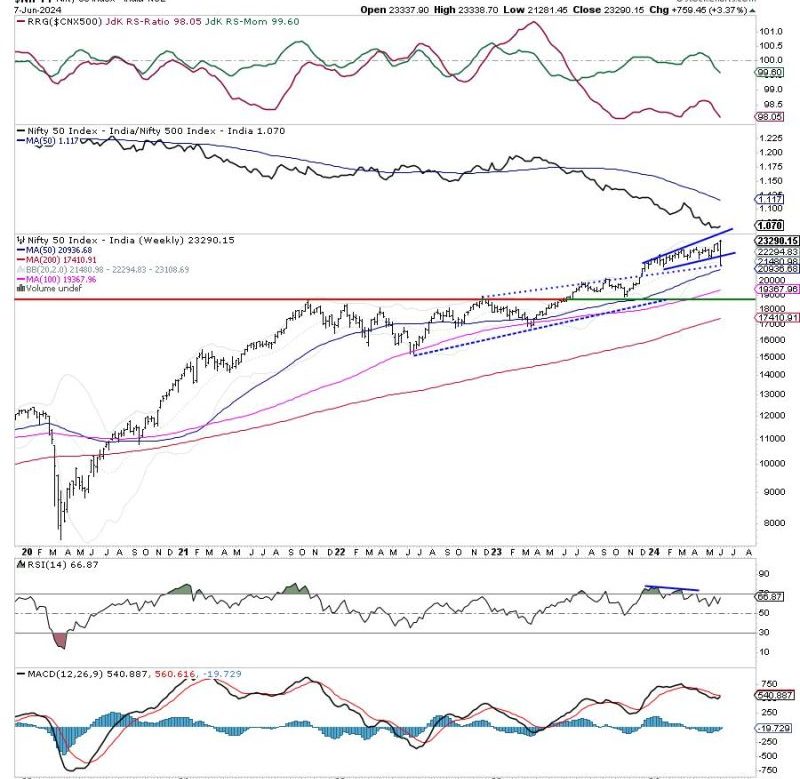

In the current market scenario, it is important for investors to stay vigilant and aware of potential risks and opportunities within the stock market. The recent pullback in Nifty has raised concerns about the overall breadth of the market and the possibility of a retracement. Despite this pullback, there are still areas of concern that investors should keep an eye on.

One of the key indicators to watch in the coming week is the market breadth, which highlights the overall health of the market. A healthy market breadth indicates that there is broad participation across various sectors and stocks. However, if market breadth weakens, it could signify that only a few stocks are driving the market higher, making it more vulnerable to sharp corrections.

Additionally, the technical analysis of Nifty suggests that it remains prone to a retracement. A retracement is a temporary reversal in the direction of an asset, which can occur after a significant move in one direction. This could potentially lead to a pullback in Nifty before resuming its upward trend.

Amidst these concerns, investors should focus on maintaining a diversified portfolio to mitigate risks. Diversification involves spreading investments across different asset classes and sectors to reduce exposure to any single risk. By diversifying their portfolio, investors can better navigate market fluctuations and protect their investments.

Furthermore, staying informed about market developments and economic indicators is crucial for making informed investment decisions. Keeping track of corporate earnings reports, economic data releases, and global market news can provide valuable insights into market trends and potential opportunities.

In conclusion, despite the recent pullback in Nifty and concerns regarding market breadth and potential retracement, investors can navigate these challenges by staying vigilant, diversifying their portfolios, and staying informed about market developments. By adopting a proactive approach and being prepared for potential market fluctuations, investors can position themselves to make informed investment decisions and navigate the dynamic landscape of the stock market.