Rules-Based Money Management: Putting Trend Following to Work

Trend following is a popular strategy in the world of trading and investing that involves identifying and following trends in the market to make profitable decisions. This approach is based on the premise that asset prices tend to move in trends and that by identifying and riding these trends, traders can capitalize on market movements and generate consistent returns over time.

One of the key principles of trend following is the idea that trends tend to persist over time. This means that once a trend is established, it is likely to continue in the same direction for a significant period before reversing. Trend followers seek to capitalize on these extended price movements by entering positions in the direction of the trend and holding them until the trend shows signs of weakening or reversing.

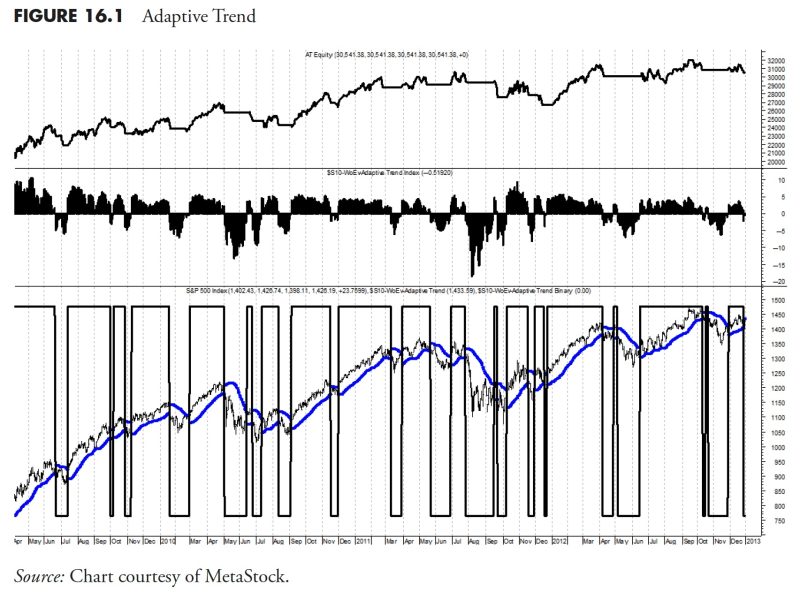

To put trend following into practice, traders typically use technical analysis tools and indicators to identify and confirm the presence of a trend in the market. Moving averages, trendlines, and momentum indicators are commonly used to determine the direction and strength of a trend and to signal potential entry and exit points for trades.

One of the key advantages of trend following is its ability to capture significant market movements and generate outsized returns during trending market conditions. By letting winners run and cutting losers quickly, trend followers aim to maximize their profits while minimizing their losses, leading to a positive risk-reward ratio over time.

However, trend following is not without its challenges. One of the main criticisms of this approach is its tendency to underperform in choppy or range-bound markets where trends are less clear or non-existent. During such periods, trend followers may experience whipsaw losses as the market moves back and forth without establishing a clear direction.

Another challenge of trend following is the difficulty of accurately identifying and entering trades at the beginning of a new trend. Since trends can be deceptive and often experience pullbacks or reversals before resuming their original direction, timing entries and exits correctly can be a significant challenge for trend followers.

Despite these challenges, many traders and investors continue to rely on trend following as a core strategy in their trading arsenal. By combining sound risk management practices, robust trading rules, and a disciplined approach to following trends, traders can potentially generate consistent profits and achieve their financial goals over the long term.

In conclusion, trend following is a powerful strategy that offers traders and investors a systematic way to profit from market trends and generate consistent returns over time. By understanding the principles of trend following, using appropriate technical analysis tools, and applying effective risk management techniques, traders can put trend following to work and potentially achieve success in the dynamic world of trading and investing.