Ride the Bull: Sparkling Buy Signals for Dow (DIA) and Russell 2000 (IWM)

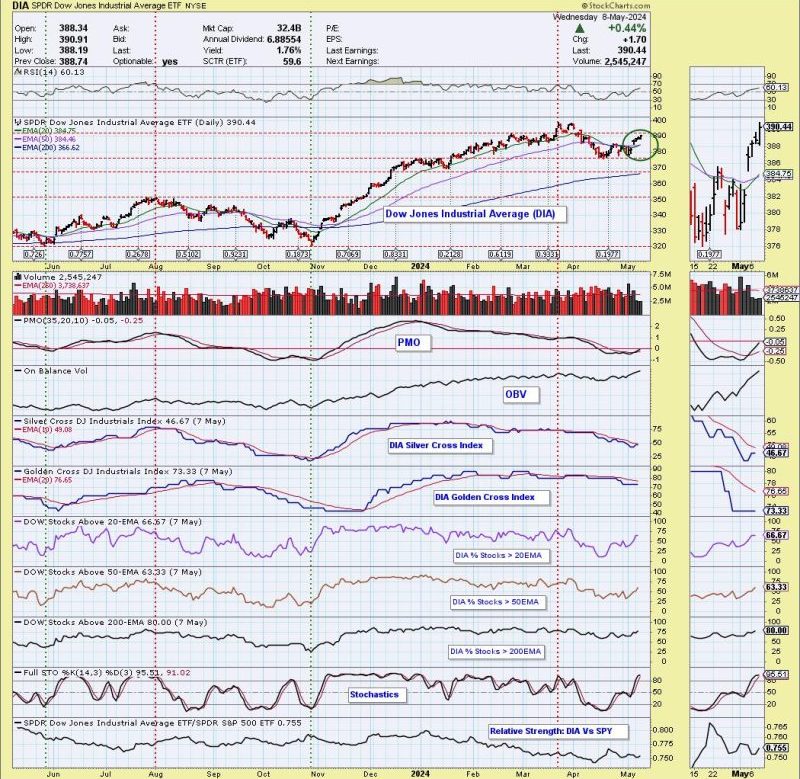

Silver Cross Buy Signals on the Dow (DIA) and Russell 2000 (IWM)

The investment world is abuzz with the recent emergence of silver cross buy signals on two key market indices: the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM). These signals are significant indicators for investors, signaling a potential uptrend in the market and offering opportunities for savvy traders to capitalize on the bullish momentum.

Silver cross buy signals occur when a short-term moving average of an index or stock crosses above a longer-term moving average. In the case of the DIA and IWM, the 50-day moving average has crossed above the 200-day moving average, indicating a shift towards positive price action and underlying strength in these indices.

The Dow Jones Industrial Average, often considered a barometer of the overall stock market, includes 30 large-cap blue-chip stocks representing various sectors of the economy. The emergence of a silver cross buy signal on the DIA suggests that these established companies are experiencing renewed investor interest and are poised for potential growth in the near future.

On the other hand, the Russell 2000 index tracks the performance of 2000 small-cap companies in the US, providing insight into the health of smaller businesses and the overall economy. The silver cross buy signal on the IWM indicates that investors are increasingly bullish on the prospects of these smaller companies, which may benefit from improving economic conditions and market sentiment.

These buy signals have prompted investors to reevaluate their investment strategies and consider potential opportunities in these indices. Traders looking to capitalize on the bullish momentum may consider taking long positions in the DIA and IWM, anticipating further price appreciation as the market trends higher.

It is important to note that while silver cross buy signals can be powerful indicators of potential market trends, they are not foolproof and should be considered alongside other technical and fundamental factors. Investors should conduct thorough research and analysis before making any investment decisions based on these signals.

In conclusion, the emergence of silver cross buy signals on the Dow Jones Industrial Average (DIA) and Russell 2000 (IWM) is an encouraging sign for investors looking to capitalize on potential market uptrends. By staying informed and conducting thorough analysis, traders can make informed decisions to potentially benefit from the bullish momentum in these key indices.