Navigate the Week Ahead: NIFTY Holds Strong Support, Watch for Thoughtful Rebounds

This week presents a crucial juncture for traders as the Nifty defends a critical support level while the Chase group focuses on rebounding mindfully. The Nifty index, a key benchmark for the Indian stock market, is especially vital for market participants. Here, we delve into the key highlights and insights for traders to keep an eye on during the week.

Technical Analysis:

At the start of the week, the Nifty defended a crucial support level, indicating a tug-of-war between the bulls and bears. This battle at important support demonstrates the underlying sentiment and the conflicting forces at play in the market. Traders need to closely monitor price action in this zone for potential breakout or breakdown signals.

Market Sentiment:

The market sentiment plays a significant role in determining the direction of stocks. With the Nifty defending its support level, traders are closely watching for any shifts in sentiment that could drive the market in either direction. Uncertainty around economic factors and global events can influence sentiment, highlighting the need for traders to stay informed and adaptable.

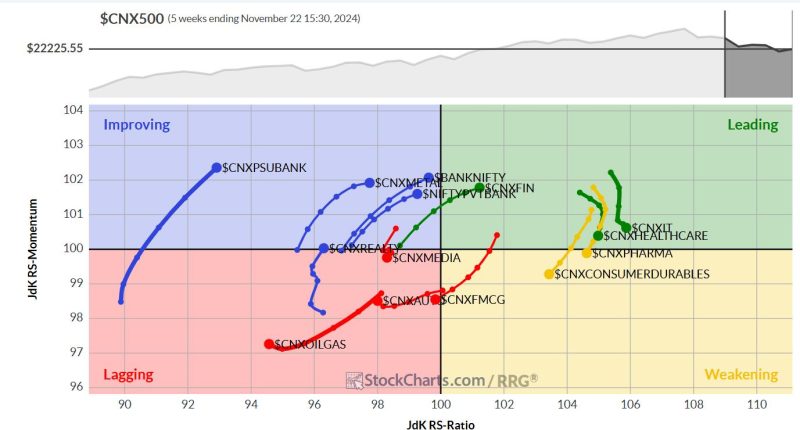

Sectoral Performance:

Sectoral performance is another crucial aspect to consider when navigating the market. Different sectors respond differently to market conditions and external factors, so it’s essential to gauge the strength and weakness of each sector. This analysis helps traders identify potential opportunities and risks within various segments of the market.

Economic Indicators:

Economic indicators provide valuable insights into the health of the economy and can influence market movements. Traders should pay attention to key economic releases such as GDP data, inflation rates, and employment figures to gauge the overall economic outlook. These indicators can offer clues about future market trends and help traders make informed decisions.

Risk Management:

Managing risk is paramount for traders looking to navigate the market successfully. Implementing sound risk management strategies such as setting stop-loss levels, diversifying portfolios, and avoiding over-leveraging can help protect capital and mitigate potential losses. Traders should prioritize risk management to preserve their investment capital and thrive in the market.

Conclusion:

As the Nifty defends crucial support and the Chase group rebounds mindfully, traders must stay vigilant and adaptable to navigate the market effectively. By keeping an eye on technical analysis, market sentiment, sectoral performance, economic indicators, and implementing robust risk management strategies, traders can position themselves for success in the dynamic market environment. By staying informed and proactive, traders can navigate market fluctuations and capitalize on opportunities that arise.