The article you referenced discusses the potential for a USD rally based on technical analysis and market conditions. Here is a unique and well-structured article based on the same topic:

—

**Analyzing the Prospects of a USD Rally**

The foreign exchange market is always a dynamic arena where various factors influence the value of currencies. In recent times, there has been anticipation and speculation about a potential rally in the US dollar (USD). Traders and analysts have been closely watching key indicators and market trends to gauge the likelihood of a bullish run for the greenback.

**Technical Analysis Pointing Towards Strength**

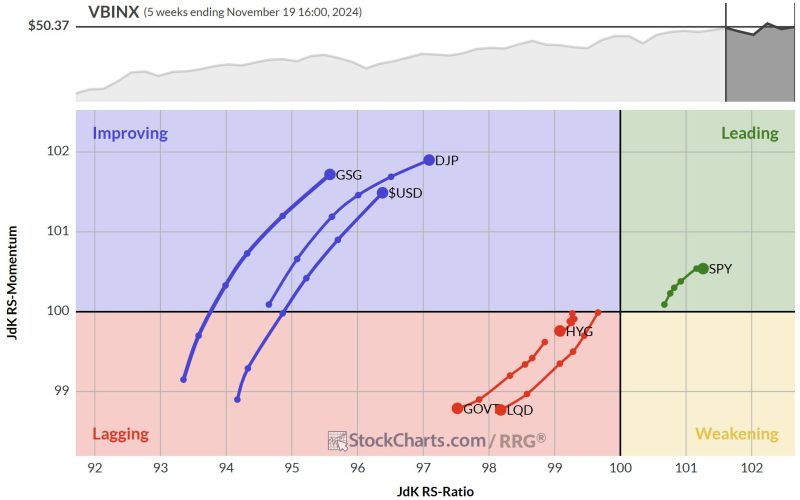

One of the primary tools used by traders to predict currency movements is technical analysis. By studying price charts and identifying patterns, traders can make informed decisions about potential market directions. In the case of the USD, technical analysts have noted certain indicators that suggest a possible rally in the near future.

For instance, the article on GodzillaNewz.com highlights the formation of a ‘W-shaped’ pattern on the USD Index chart. This pattern typically indicates a reversal in the current trend, with the potential for an upward movement in prices. Additionally, key moving averages and support levels are being closely monitored by analysts for signs of a bullish momentum building up.

**Market Sentiment and Economic Factors**

Apart from technical analysis, market sentiment and economic factors also play a crucial role in determining the strength of a currency. In the case of the USD, geopolitical developments, interest rate decisions, and overall economic performance can significantly impact its value in the global market.

The recent uncertainty surrounding geopolitical tensions, particularly trade disputes and diplomatic relations, has added a level of volatility to the USD. Additionally, the Federal Reserve’s stance on interest rates and economic data releases, such as employment figures and GDP growth, can sway market sentiment towards or against the USD.

**Investor Behavior and Risk Appetite**

Investor behavior and risk appetite are key drivers of currency movements. In times of uncertainty, investors often seek safe-haven assets like the USD, which can lead to an increase in demand and a consequent rally in its value. Factors like political instability, global economic slowdown, and market volatility can prompt investors to flock to currencies perceived as safe bets.

Conversely, a shift in risk sentiment towards higher-yielding assets or positive economic outlooks in other regions can lead to a weakening of the USD as investors diversify their portfolios. Understanding investor behavior and market dynamics is essential in predicting and analyzing potential currency rallies.

**Conclusion**

In conclusion, the prospects of a USD rally are influenced by a combination of technical analysis, market sentiment, economic factors, and investor behavior. While indicators suggest the possibility of a bullish run for the greenback, unforeseen events and developments can impact its value in the global foreign exchange market. Traders and analysts will continue to monitor key indicators and market trends to make informed decisions and capitalize on potential opportunities in the currency market.

—

This structured article provides an in-depth analysis of the potential USD rally, incorporating key factors that influence currency movements, investor behavior, and market dynamics.