Triple Confirmation: Bearish Phase Backed by Market Sentiment Indicators

Market Sentiment Indicators: A Guide to Understanding Bearish Phases

Market sentiment indicators play a crucial role in analyzing the prevailing mood and expectations of investors in financial markets. By gauging sentiment, investors can better understand the potential direction of asset prices, identify market trends, and make informed investment decisions. In this article, we will explore three key market sentiment indicators that confirm a bearish phase in the market.

1. Put/Call Ratio: The put/call ratio is a popular sentiment indicator that compares the number of open put options to open call options in the market. A high put/call ratio suggests that investors are purchasing more put options, indicating a bearish sentiment as they are hedging against potential price declines. Conversely, a low put/call ratio implies a bullish sentiment, as investors are more optimistic about the market’s direction.

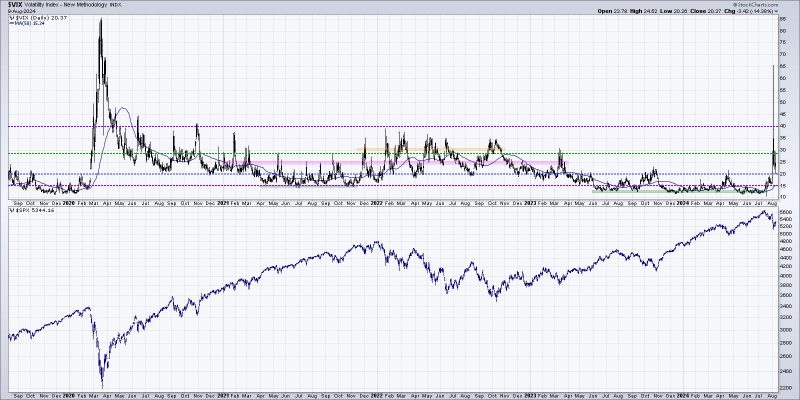

2. VIX Index: The Volatility Index (VIX) is another important sentiment indicator that measures market volatility and investor fear. Often referred to as the fear index, the VIX tends to rise during periods of market uncertainty and decline during bullish phases. A high VIX level indicates increased market volatility and fear, which is typically associated with bearish market conditions. On the other hand, a low VIX level suggests reduced uncertainty and a more bullish market sentiment.

3. Investor Sentiment Surveys: Various investor sentiment surveys, such as the American Association of Individual Investors (AAII) sentiment survey and the Investor Intelligence survey, provide valuable insights into investor sentiment and market expectations. These surveys typically ask investors about their outlook on the market, whether they are bullish, bearish, or neutral. A high percentage of bearish investors in these surveys often signals a bearish phase in the market, as excessive pessimism can lead to selling pressure and downward price movements.

In conclusion, market sentiment indicators are essential tools for investors to assess the prevailing mood and expectations in financial markets. By analyzing indicators such as the put/call ratio, VIX index, and investor sentiment surveys, investors can gain valuable insights into potential market trends and make more informed investment decisions. During bearish phases, heightened levels of fear, increased volatility, and widespread pessimism are key indicators that suggest a challenging market environment. By incorporating sentiment analysis into their investment strategy, investors can better navigate volatile market conditions and position themselves for success in the long term.