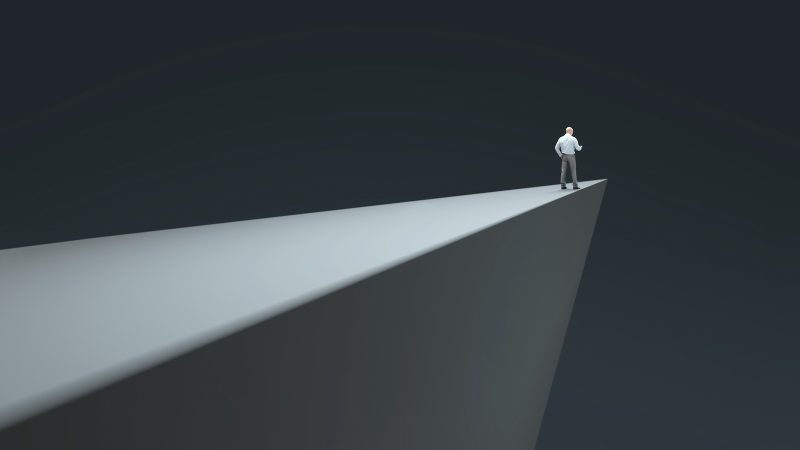

The Nasdaq: Critical Levels to Watch as Index Teeters on the Edge

Technical analysis is a valuable tool for traders and investors seeking to gauge market sentiment and identify potential trends. The Nasdaq composite index, which is comprised of technology and growth-oriented companies, has been a key barometer of market performance in recent years. As the index teeters on the edge of critical levels, it is essential for market participants to monitor key technical indicators and levels for potential signs of a trend reversal or continuation.

Support and Resistance Levels:

Support and resistance levels are widely used in technical analysis to identify key price levels at which a stock or index is likely to encounter buying or selling pressure. In the case of the Nasdaq composite index, key support and resistance levels can provide important insights into potential market direction.

Currently, the Nasdaq is hovering near a critical support level around the 14,000 mark. If the index breaches this level, it may signal further downside potential, potentially leading to a more pronounced correction. On the flip side, a bounce off this support level could indicate a potential reversal and signal strength in the market.

Relative Strength Index (RSI):

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is used to identify overbought or oversold conditions in a stock or index. The RSI for the Nasdaq is currently hovering around the 50 level, indicating that the index is neither overbought nor oversold.

Traders and investors should watch for potential divergences between price action and the RSI, as these can signal a potential trend reversal or continuation. If the Nasdaq starts to diverge from the RSI, it may indicate a shift in market sentiment and signal a potential change in direction.

Moving Averages:

Moving averages are commonly used in technical analysis to identify trends and potential areas of support or resistance. The 50-day and 200-day moving averages are widely followed by traders and investors as key indicators of trend strength.

Currently, the Nasdaq is trading above both its 50-day and 200-day moving averages, indicating that the overall trend remains bullish. Traders should watch for potential crossovers or breaks below these moving averages, as they can provide important signals of a potential trend reversal.

In conclusion, monitoring key technical indicators and levels is essential for traders and investors seeking to navigate the ever-changing market landscape. As the Nasdaq teeters on the edge of critical levels, staying informed and being prepared to adapt to changing market conditions is crucial for success in today’s volatile markets. By keeping a close eye on support and resistance levels, the Relative Strength Index, and moving averages, market participants can more effectively assess market sentiment and make informed trading decisions.