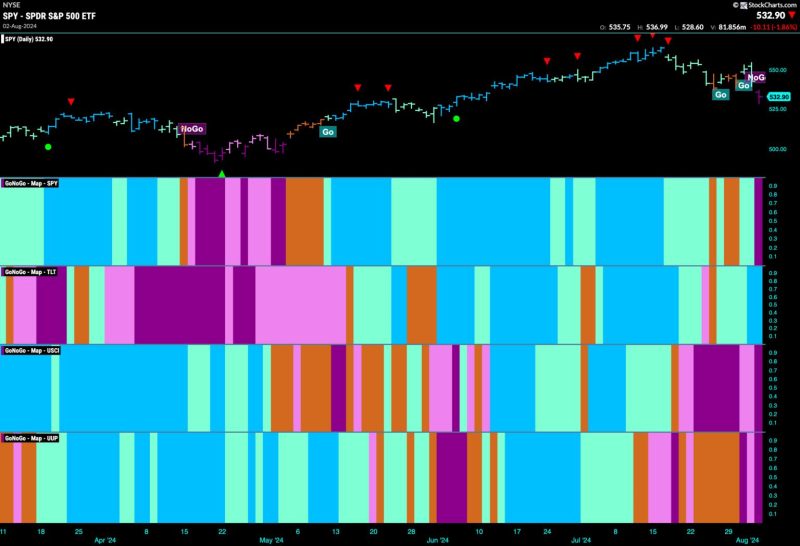

Stocks Get Defensive as Market Index Enters No-Go Zone

The recent performance of the market index has sparked a shift towards defensive stocks among investors. As uncertainties loom and market volatility remains high, many are turning to defensive sectors in search of stability and protection for their investments.

Defensive stocks, characterized by their resilience during economic downturns and ability to generate consistent returns regardless of market conditions, have attracted increased interest in the current climate of uncertainty. These stocks typically belong to sectors such as consumer staples, healthcare, and utilities, which provide essential products and services that are in demand regardless of economic conditions.

The shift towards defensive stocks is a reflection of investors’ growing concerns about the sustainability of the current market rally. With various factors like inflation, supply chain disruptions, and geopolitical tensions contributing to market jitters, investors are looking for safer options to weather the storm.

Consumer staples companies, known for producing everyday products like food, beverages, and household items, are considered defensive stocks due to the constant demand for their products. These companies tend to perform well in both good and bad economic times, making them an attractive choice for investors seeking stability and reliability.

Healthcare stocks are also a popular choice among investors seeking defensive options. The healthcare sector is known for its resilience, as people continue to require medical services regardless of economic conditions. Pharmaceutical companies, healthcare providers, and medical equipment manufacturers are among the defensive stocks in this sector that have the potential to outperform during uncertain times.

Utilities are another area where investors are flocking for defensive positioning. Utility companies provide essential services such as electricity, water, and natural gas, making them less susceptible to economic downturns. These companies often have stable cash flows and pay attractive dividends, making them a favored choice for income-seeking investors looking for safety.

In conclusion, the current market environment has prompted investors to reassess their portfolios and shift towards defensive stocks to mitigate risks and protect their investments. As uncertainties persist and market volatility remains a concern, defensive sectors such as consumer staples, healthcare, and utilities offer a safe haven for investors looking for stability and reliable returns. By diversifying their portfolios and including defensive stocks, investors can navigate turbulent markets with greater confidence and resilience.