Unveiling the Breadth Indicator: Signals for Further Declines and a Lucrative Opportunity

The article available through the provided link discusses the potential for a further downside in the market based on a breadth indicator. Furthermore, it highlights a potential opportunity that may arise as a result. In this article, we will delve deeper into the concept of breadth indicators, their significance in the financial markets, and how investors can interpret and leverage this information.

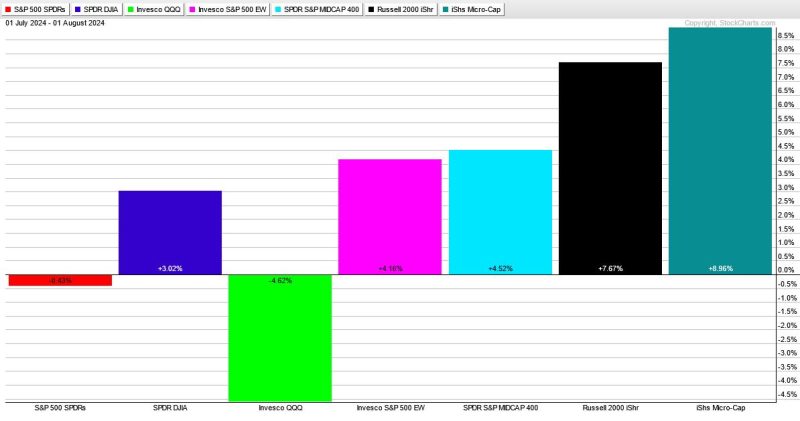

Breadth indicators play a crucial role in analyzing the overall health and direction of the market. These indicators measure the number of assets participating in a price movement. In essence, they provide a more comprehensive view of market movements beyond just focusing on individual securities or indices. A breadth indicator can help investors gauge the strength or weakness of a market trend by looking at the number of advancing versus declining assets.

One common breadth indicator is the Advance-Decline Line (AD Line), which compares the number of advancing stocks to declining stocks in a given market. A rising AD Line suggests broad participation in the market rally, indicating a healthy and sustainable uptrend. Conversely, a declining AD Line may signal weakening market breadth, potentially foreshadowing a market reversal.

In the context of the article, the breadth indicator is pointing towards more downside in the market. This could imply that the recent market rally is losing momentum, with fewer stocks participating in the upward movement. A lack of market breadth could make the rally more vulnerable to a correction or a broader pullback.

While a negative breadth indicator may suggest caution for investors, it can also present opportunities for those willing to take a contrarian stance. As the saying goes, the trend is your friend until the end. By being aware of market breadth indicators, investors can better prepare for potential shifts in market sentiment and identify entry points for contrarian positions.

It is essential for investors to combine breadth indicators with other technical and fundamental analysis tools to make well-informed investment decisions. Diversification, risk management, and staying attuned to market developments are key principles that can help investors navigate volatile market conditions and capitalize on potential opportunities that arise.

In conclusion, breadth indicators offer valuable insights into market participation and can serve as useful tools for investors seeking to gauge market strength and identify potential turning points. While a negative breadth indicator may signal downside risk, it can also uncover opportunities for contrarian investors. By understanding and incorporating breadth indicators into their investment approach, investors can enhance their decision-making process and adapt to changing market dynamics effectively.