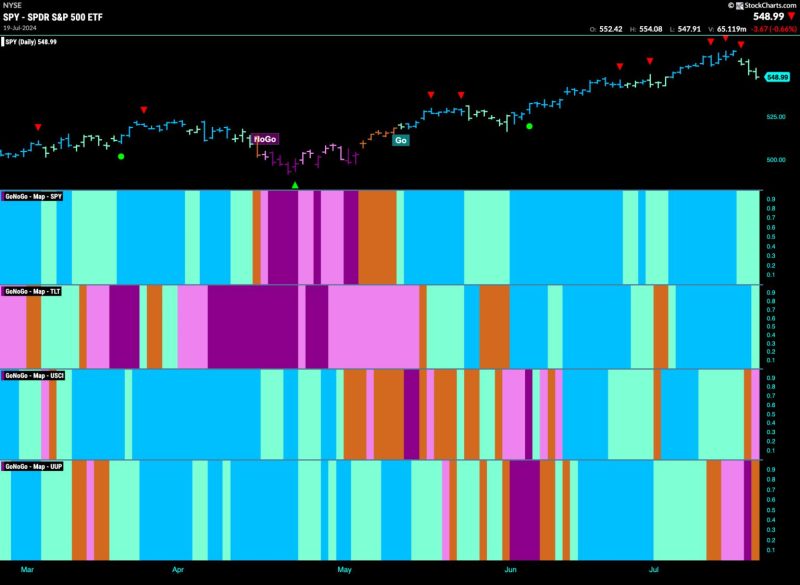

In recent times, there has been a notable shift in the financial markets as the equity market trend weakens, paving the way for the outperformance of other financial instruments. This shift has garnered significant attention and raised questions about the implications for investors and the broader economy.

One of the key factors contributing to this shift is the changing dynamics within the global economy. With uncertainties surrounding trade tensions, geopolitical risks, and slowing economic growth in key regions, investors are turning to alternative asset classes such as bonds, commodities, and currencies. These assets have started to outperform equities, offering better risk-adjusted returns in the current market environment.

Moreover, central bank policies play a crucial role in shaping market sentiment and driving asset prices. The shift towards more accommodative monetary policies by central banks around the world has provided support to fixed income securities and safe-haven assets. As interest rates are lowered and quantitative easing measures are implemented, investors are reallocating their portfolios to capture yield and protect against downside risks.

Another significant factor contributing to the outperformance of financials is the divergence in sector performance. Traditional equity sectors such as technology and consumer discretionary, which have been the main drivers of the bull market, are starting to show signs of fatigue. In contrast, defensive sectors like utilities, healthcare, and consumer staples are holding up well and attracting investor interest due to their stable cash flows and defensive qualities.

Furthermore, the recent inversion of the yield curve has raised concerns about an impending recession. Historically, an inverted yield curve has been a reliable indicator of economic downturns, leading investors to seek safety in fixed income assets. This flight to quality has further boosted the performance of bonds and created opportunities for diversified portfolios.

As the equity market trend weakens and financials begin to outperform, investors are advised to reassess their investment strategies and diversify their portfolios to navigate the evolving market dynamics. By incorporating a mix of asset classes and staying informed about macroeconomic trends and policy developments, investors can position themselves to weather market fluctuations and capitalize on opportunities in a changing financial landscape.

In conclusion, the shift towards financials outperforming equities reflects a broader reevaluation of risk and return dynamics in today’s market environment. By understanding the underlying factors driving this shift and adjusting their investment strategies accordingly, investors can make informed decisions to protect and grow their wealth in a changing economic landscape.