The Hindenburg Omen Flashes Initial Sell Signal: Understanding Market Indicators

The Hindenburg Omen, a technical analysis signal that has captured the attention of both seasoned investors and newcomers to the stock market, has recently flashed an initial sell signal. This indicator, named after the infamous Hindenburg disaster of 1937, is used by traders to predict potential market downturns based on observable patterns in stock market data. While the accuracy and reliability of the Hindenburg Omen remain subjects of debate among financial experts, understanding how it works can provide valuable insights into market dynamics.

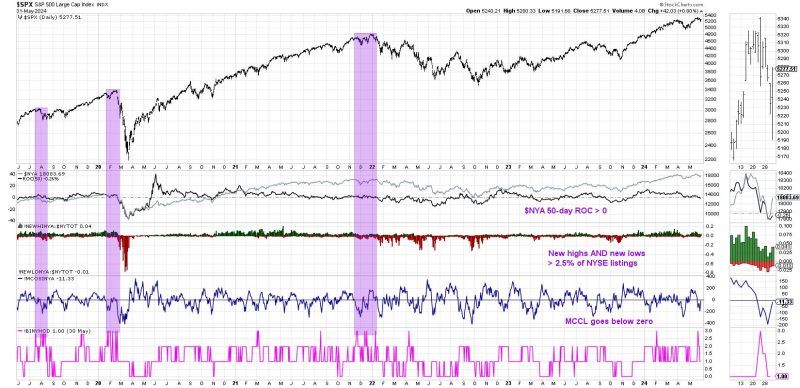

At the core of the Hindenburg Omen is the concept of market breadth, which refers to the number of individual stocks advancing or declining in price at a given time. The indicator considers several factors, including new highs and lows, advancing and declining issues, and the 10-week moving average of the NYSE Composite Index. When specific conditions are met, such as a high number of new highs and lows coupled with a declining index, the Hindenburg Omen is triggered, suggesting a heightened risk of a market correction.

One key aspect of the Hindenburg Omen is its focus on conflicting signals within the market. The presence of both new highs and new lows indicates a lack of uniformity in stock performance, signaling potential underlying weakness. This divergence is seen as a warning sign that investor sentiment may be shifting, leading to increased market volatility and the possibility of a downturn.

It is important to note that while the Hindenburg Omen has been associated with market declines in the past, it is not infallible. False signals can occur, leading to missed opportunities or unnecessary panic among investors. As with any technical indicator, it is crucial to consider multiple factors and not rely solely on the Hindenburg Omen when making investment decisions.

Traders and investors should approach the Hindenburg Omen with caution and use it as one of many tools in their analytical toolkit. Combining technical analysis with fundamental research and market sentiment can provide a more comprehensive understanding of market conditions and help in making informed investment choices.

In conclusion, the Hindenburg Omen serves as a reminder of the complexities of the stock market and the importance of monitoring multiple indicators to gauge market health. While the recent initial sell signal may raise concerns among market participants, it is essential to maintain a long-term perspective and consider the broader economic and geopolitical factors influencing market movements. By staying informed and remaining disciplined in their approach, investors can navigate market fluctuations with greater confidence and resilience.