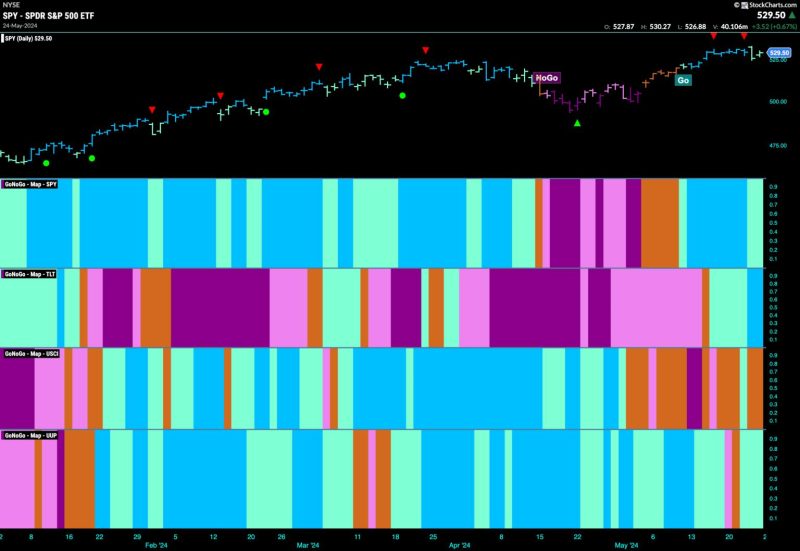

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The equity markets have continued to show strength in recent times, maintaining a positive trend that has been characterized by resilience and optimism. However, as we delve into the market dynamics, it becomes clear that certain sectors are taking the lead while others lag behind. In this analysis, we will explore the current state of equities, with a focus on the limited leadership from the technology and utilities sectors.

Technology, which has long been a powerhouse in driving market performance, seems to have taken a backseat in recent months. This shift comes as a surprise to many, given the sector’s historical performance and impact on the broader market. However, a closer look reveals that other areas of the market are now capturing investors’ attention, leading to reduced leadership from tech companies.

One possible explanation for the subdued performance of the technology sector could be attributed to the rotation into other sectors that are perceived as more defensive or offering better value at the moment. Investors may be seeking opportunities in areas such as healthcare, consumer staples, or even industrials, which are seen as more resilient in times of economic uncertainty.

On the other hand, the utilities sector, known for its stability and dividend-paying capabilities, is also lacking the strong leadership that one would typically expect in a bullish market. Utilities have often been viewed as a safe haven during turbulent times, providing investors with consistent returns and low volatility. However, the current market dynamics suggest that this sector is not driving the market momentum as much as in the past.

It is essential to note that while tech and utilities may not be at the forefront of market leadership currently, their roles in the broader market landscape should not be underestimated. These sectors still play a crucial part in providing diversification options for investors and contributing to the overall stability of the market.

Looking ahead, it will be interesting to see how the leadership dynamics in the equity markets evolve. Will tech regain its dominance, or will other sectors continue to lead the way? Only time will tell. In the meantime, investors should stay informed, keep a close eye on market trends, and be prepared to adapt their strategies to navigate the ever-changing landscape of equities.