Tech Breakthrough: Equities Soar to Record Highs Across Leadership Sectors

Equities Hit All-Time Highs as Technology Joins Leadership Groups

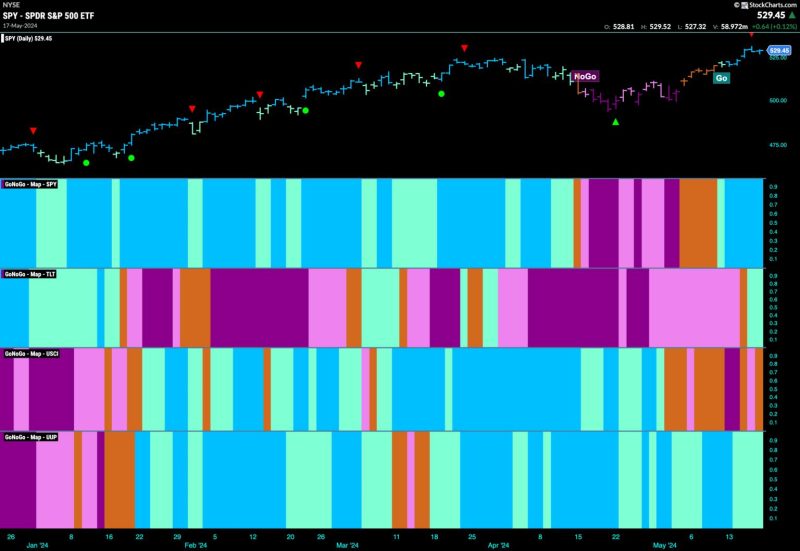

The stock market continues to surge forward as equities hit all-time highs, fueled by the latest rally in the technology sector. The tech sector has emerged as a prominent leader in driving the markets higher, showcasing its resilience in the face of economic uncertainties and global challenges. This surge in technology stocks has not only propelled major indices to record levels but has also reshaped the leadership landscape within the equity markets.

One of the key drivers behind the technology sector’s outperformance is the increasing digitalization and tech adoption across various industries. As businesses and consumers increasingly rely on technology for communication, productivity, and entertainment, companies at the forefront of technological innovation are reaping the rewards. The demand for cutting-edge technologies, such as cloud computing, artificial intelligence, and e-commerce platforms, has propelled tech stocks to new heights.

Additionally, the work-from-home trend sparked by the global pandemic has further boosted the tech sector, with companies providing remote work solutions, cybersecurity services, and digital communication tools experiencing rapid growth. As more businesses invest in digital transformation initiatives to adapt to the new normal, tech firms are poised to benefit from this ongoing shift towards a digital-first economy.

Moreover, the low-interest-rate environment and ample liquidity provided by central banks have created a favorable backdrop for risk assets, including equities. With interest rates at historic lows and bond yields remaining subdued, investors have turned to the stock market in search of higher returns. The technology sector, with its strong growth prospects and ability to generate sustainable earnings, has become an attractive destination for investors seeking capital appreciation.

The rally in technology stocks has led to a reshuffling of the leadership groups within the equity markets. Traditional sectors like financials, energy, and industrials have taken a back seat, while technology and other growth-oriented sectors have ascended to the forefront. As investors reallocate their portfolios to capitalize on the tech sector’s momentum, the market dynamics are evolving, with growth and momentum stocks outperforming value plays.

While the surge in technology stocks has fueled optimism and exuberance among investors, it has also raised concerns about market valuations and potential bubbles. As technology stocks reach lofty levels and trade at premium multiples, some market participants worry about a potential correction or pullback in the sector. It is essential for investors to exercise caution and diversify their portfolios to mitigate risks associated with sector concentration.

In conclusion, the stock market’s relentless rally to all-time highs, driven by the technology sector’s leadership, reflects the ongoing transformation of the global economy towards a digital future. As technology continues to revolutionize industries and reshape business models, investors stand to benefit from the sector’s growth potential. However, prudent risk management and a diversified investment approach are crucial to navigate the markets’ uncertainties and capitalize on the opportunities presented by the evolving equity landscape.