Ahead: Brace for Market Uncertainty; Watch Out for this Defensive Sector’s Rise

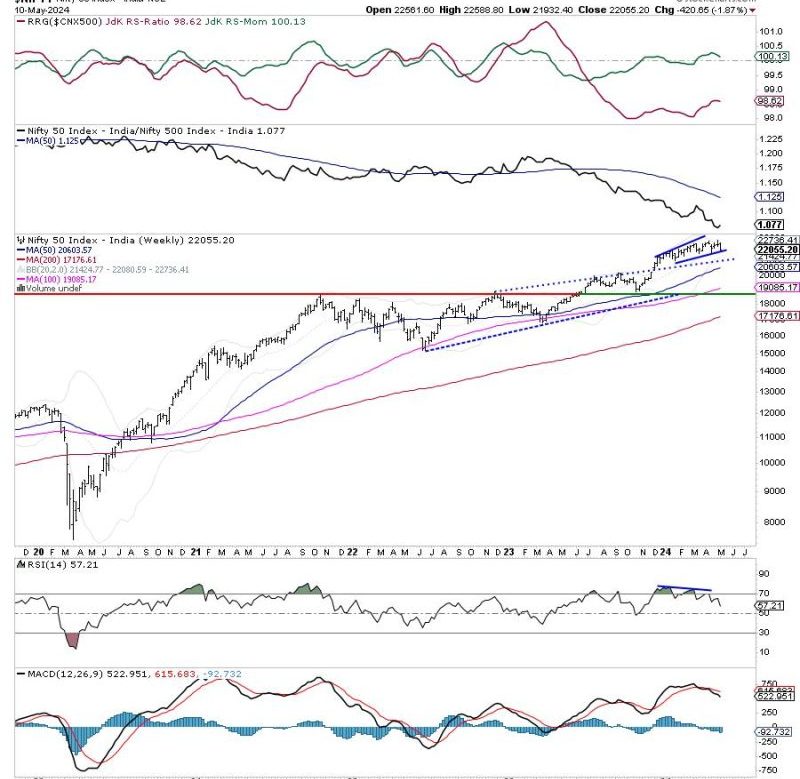

The article discusses the market outlook for the coming week and identifies a defensive sector that may exhibit relative outperformance. Investors are advised to stay cautious as the markets are expected to remain tentative in the near term. This caution is particularly warranted given the ongoing uncertainty surrounding global events and economic indicators.

One key area of interest is the defensive sector, which could potentially provide some stability and relative outperformance in the current market environment. Defensive sectors typically consist of industries that are less susceptible to economic downturns, such as utilities, consumer staples, and healthcare. These sectors are seen as more resilient in times of market turbulence due to their stable demand patterns and essential nature of their products and services.

Investors seeking to reduce risk in their portfolios may consider allocating a portion of their investments to defensive sectors. While these sectors may not offer the same level of growth potential as more cyclical industries, they can provide a buffer against market volatility and economic uncertainty.

It is important for investors to conduct thorough research and analysis before making any investment decisions. This includes evaluating the individual stocks within the defensive sector, assessing their financial health, competitive positioning, and growth prospects. Diversification across different industries and asset classes is also key to managing risk and achieving a balanced portfolio.

In summary, the upcoming week is likely to see continued caution in the markets, with investors closely monitoring economic data and global events for signs of potential risks. The defensive sector may present an opportunity for relative outperformance in this uncertain environment, offering a potential safe haven for investors looking to protect their portfolios from market volatility. By staying informed, conducting due diligence, and maintaining a diversified investment strategy, investors can navigate the current market conditions with prudence and confidence.