Unlock Trading Opportunities with Diverging Tails on the Relative Rotation Graph

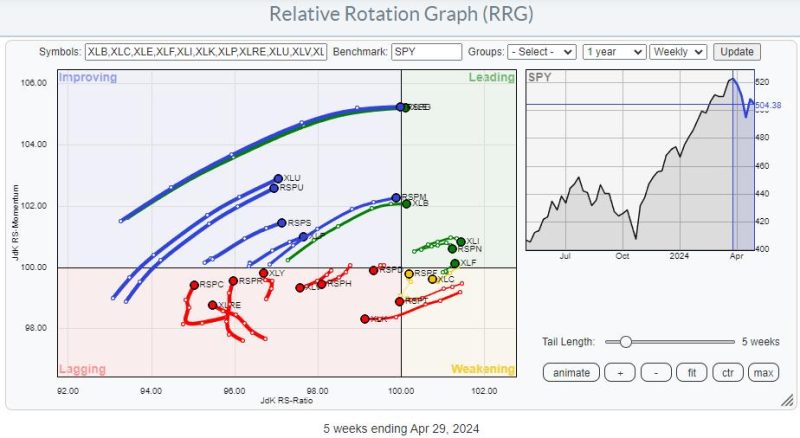

Relative rotation graphs (RRGs) have become a popular tool among traders and investors for analyzing market trends and identifying potential trading opportunities. These graphs provide a visual representation of the relative strength and momentum of different asset classes or securities, helping traders make informed decisions based on the underlying dynamics of the market.

In a recent analysis of RRGs, diverging tails were observed, signaling potential trading opportunities for astute investors. Understanding the implications of these diverging tails is crucial for traders looking to capitalize on shifting market trends and potential profit opportunities.

Diverging tails on an RRG indicate that two assets or securities are moving in opposite directions in terms of relative strength and momentum. This can suggest a potential shift in market dynamics, with one asset gaining strength while the other weakens. By identifying assets with diverging tails on an RRG, traders can pinpoint potential opportunities to capitalize on these changing trends.

One key strategy for traders looking to exploit diverging tails on an RRG is pair trading. Pair trading involves taking a long position in one asset while simultaneously taking a short position in another related asset. By capitalizing on the divergence in relative strength and momentum between the two assets, traders can potentially profit from market inefficiencies and take advantage of changing market dynamics.

Another approach is to use diverging tails on an RRG as a signal for potential sector rotation opportunities. By identifying sectors or industries with diverging tails, traders can reallocate their portfolios to sectors that are gaining strength and momentum while reducing exposure to sectors that are weakening. This can help traders stay ahead of market trends and position their portfolios for potential outperformance.

However, it is important for traders to exercise caution when interpreting diverging tails on an RRG. While they can provide valuable insights into shifting market dynamics, they are not foolproof indicators of future performance. Traders should conduct thorough research and analysis to confirm their trading decisions and manage risk effectively.

In conclusion, diverging tails on a relative rotation graph unveil trading opportunities for savvy investors willing to capitalize on shifting market trends. By understanding the implications of these divergences and employing appropriate trading strategies, traders can potentially profit from market inefficiencies and position their portfolios for outperformance.