Maximize Your Profits: Unleashing the Power of Relative Strength and Other Metrics in Money Management

In the realm of finance and investment, the use of rules-based money management strategies can provide clarity and discipline to investors seeking to optimize their portfolios. One such important tool in this approach is relative strength analysis, which allows investors to compare the performance of one asset or security to another. By leveraging relative strength and other key measures, investors can make informed decisions and enhance their overall investment outcomes.

Relative strength analysis serves as a powerful tool in evaluating the relative performance of various assets or securities within a given universe. This approach allows investors to identify investments that are outperforming their peers and potentially capitalize on these trends. By comparing the price performance of assets against a benchmark or against each other, investors can gain insights into which investments are showing strength and which are relatively weaker.

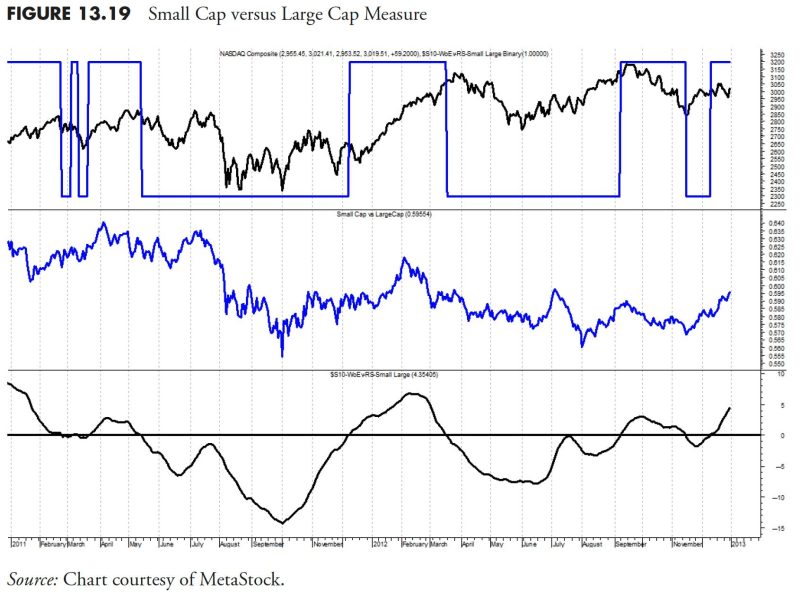

One common method of utilizing relative strength analysis is through the construction of relative strength charts. These charts display the performance of an asset relative to a chosen benchmark over a specific time period, highlighting whether the asset is outperforming or underperforming the benchmark. By visually analyzing these charts, investors can quickly identify trends, spot potential opportunities, and make more informed investment decisions.

In addition to relative strength analysis, there are other key measures that investors can incorporate into their rules-based money management strategies to enhance their decision-making process. Some of these measures include moving averages, momentum indicators, and volatility measures. Moving averages can help smooth out price fluctuations and identify trends, while momentum indicators can signal the strength and direction of price movements. Volatility measures, such as standard deviation or average true range, provide insights into the level of price fluctuations and risk associated with an investment.

By integrating these various measures into their investment process, investors can develop a well-rounded approach to assessing and managing their portfolios. Rules-based money management strategies offer a structured framework for making investment decisions based on objective criteria rather than emotions or hunches. By relying on these rules and measures, investors can avoid the pitfalls of impulsive decision-making and better position themselves for long-term success in the financial markets.

In conclusion, relative strength analysis and other key measures play a critical role in rules-based money management strategies, helping investors navigate the complexities of the financial markets and make more informed investment decisions. By leveraging these tools effectively, investors can enhance their portfolio performance, manage risk more effectively, and achieve their financial goals with greater confidence.