Rules-Based Money Management: Part 2 – Measuring the Market

Market sentiment is a key driver behind the ebb and flow of financial markets across the globe. In the realm of rules-based money management, understanding market sentiment is crucial for making informed investment decisions and managing risk effectively. By measuring the market in various ways, investors can gain valuable insights into market dynamics and potentially improve their investment outcomes.

One common method of measuring the market is through the examination of market breadth indicators. Market breadth indicators provide a snapshot of the overall health of the market by analyzing the number of advancing versus declining stocks. Investors can use market breadth indicators to gauge the level of participation in market movements and identify potential shifts in market trends.

Another important aspect of measuring the market is analyzing market momentum. Market momentum refers to the speed and strength of price movements in the market. Investors can utilize momentum indicators, such as the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI), to assess the momentum of the market and identify potential entry and exit points for trades.

Volatility is another key factor to consider when measuring the market. Volatility measures the degree of variation in price movements over a specific period. Investors can use volatility indicators, such as the Average True Range (ATR) or the Volatility Index (VIX), to assess the level of risk in the market and adjust their trading strategies accordingly.

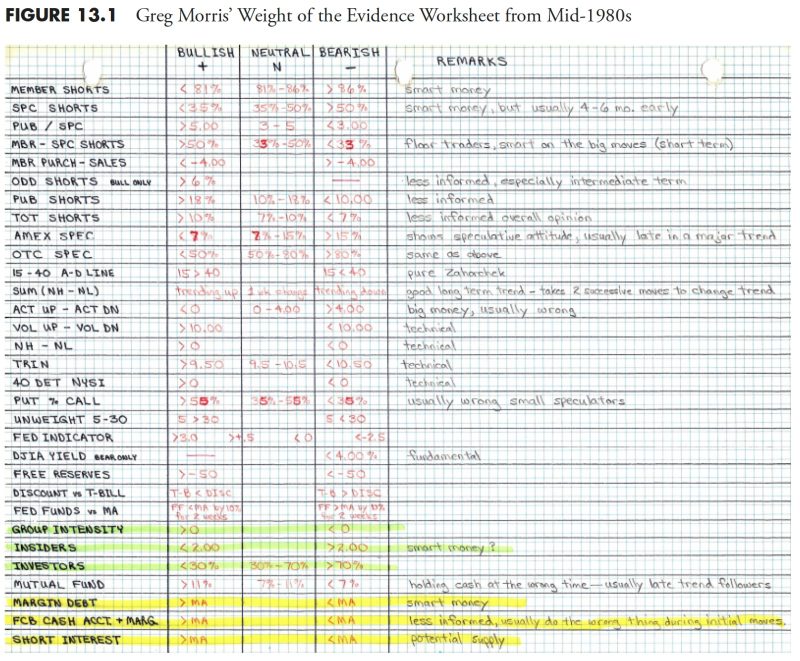

In addition to market breadth, momentum, and volatility indicators, investors can also analyze market sentiment indicators to gauge the prevailing mood of market participants. Market sentiment indicators, such as the Fear and Greed Index or the Put/Call Ratio, provide insights into investor sentiment and can help investors determine whether the market is overly bullish or bearish.

Overall, measuring the market through various indicators and tools is essential for effective rules-based money management. By analyzing market breadth, momentum, volatility, and sentiment, investors can make more informed investment decisions and adapt their strategies to changing market conditions. Incorporating a comprehensive approach to measuring the market can help investors navigate the complexities of the financial markets and enhance their overall trading performance.