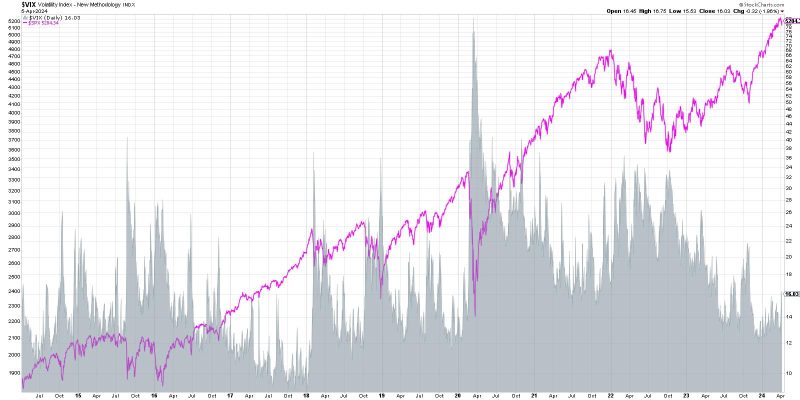

The recent spike in the VIX index above 16 has sparked concerns among market participants about the potential implications for the future of the financial markets. The VIX, also known as the fear gauge or CBOE Volatility Index, measures market volatility and is often seen as a barometer of investor sentiment. When the VIX rises, it typically indicates that investors are anticipating increased market turbulence and uncertainty.

One of the key reasons for the spike in the VIX above 16 is the growing concerns surrounding global economic conditions and geopolitical tensions. Uncertainties related to trade conflicts, geopolitical risks, and global growth slowdowns have been weighing on investor sentiment, leading to heightened market volatility. Investors are closely monitoring developments in key regions such as the U.S.-China trade war, Brexit negotiations, and the Middle East tensions, all of which have the potential to impact financial markets significantly.

Moreover, the recent inversion of the yield curve has added to market jitters, with many investors interpreting this as a signal of an impending recession. Historically, yield curve inversions have been reliable indicators of economic downturns, and this has further contributed to the heightened risk aversion among market participants.

In addition to external factors, the upcoming U.S. presidential election and the uncertainty surrounding the outcome have also been cited as potential drivers of increased market volatility. Investors are bracing for the possibility of policy shifts and regulatory changes depending on the election results, which could further impact market dynamics.

Furthermore, the current low-interest-rate environment has pushed investors towards riskier assets in search of higher yields, increasing market vulnerabilities. The hunt for yield has led to asset price inflation and stretched valuations in various market segments, increasing the likelihood of sharp corrections in the event of adverse market conditions.

As the VIX remains elevated above 16, investors are advised to exercise caution and review their risk exposures. Diversification, hedging strategies, and maintaining a long-term investment perspective are essential tools for navigating turbulent market environments. While short-term market fluctuations are inevitable, focusing on fundamental analysis, prudent risk management, and staying informed about macroeconomic trends can help investors weather periods of heightened volatility.

In conclusion, the recent spike in the VIX index above 16 underscores the prevailing uncertainties and risks in the financial markets. By staying vigilant, adapting to changing market conditions, and maintaining a disciplined investment approach, investors can better position themselves to navigate through periods of increased volatility and uncertainty.