Sentiment and Small Caps: A Powerful Combination Defeating Bearish Trends

The world of investment can often feel like a battle between bulls and bears, with market sentiment playing a crucial role in determining the direction of stock prices. In recent times, one trend that has been gaining traction is the use of small-cap stocks in combination with positive sentiment indicators to overcome bearish pressures in the market.

Small-cap stocks, which represent companies with relatively small market capitalizations, have long been considered riskier investments compared to their larger counterparts. However, their potential for high growth and strong returns has made them an attractive option for investors seeking opportunities in a volatile market environment.

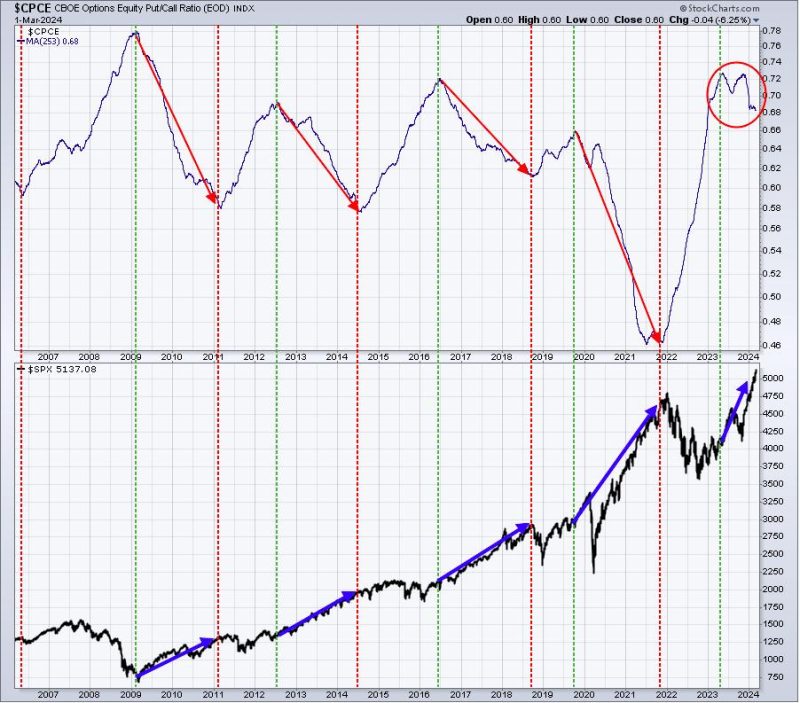

On the other hand, sentiment indicators such as investor sentiment surveys, social media sentiment analysis, and options market sentiment provide insights into market participants’ emotions and expectations regarding the future direction of stock prices. By analyzing sentiment data, investors can gauge the overall optimism or pessimism in the market and make informed decisions about their investment strategies.

When small-cap stocks are combined with positive sentiment indicators, it creates a powerful synergy that can help investors navigate through turbulent market conditions. The rationale behind this strategy is that small-cap stocks, with their inherent volatility, are more likely to experience larger price swings in response to changes in market sentiment. This characteristic makes them particularly sensitive to shifts in investor sentiment, presenting opportunities for investors to capitalize on market sentiment trends.

By leveraging sentiment analysis tools and focusing on small-cap stocks exhibiting positive sentiment indicators, investors can potentially outperform the market and achieve above-average returns. This strategy allows investors to ride the wave of positive sentiment and benefit from the upward momentum created by optimistic market participants.

Furthermore, the combination of sentiment and small caps can also serve as a valuable risk management tool. In times of heightened market uncertainty and bearish sentiment, small-cap stocks may experience sharper declines compared to larger, more stable stocks. However, by closely monitoring sentiment indicators, investors can identify potential turning points in market sentiment and adjust their investment positions accordingly to mitigate losses and capitalize on emerging opportunities.

In conclusion, the fusion of sentiment analysis and small-cap stocks represents a potent strategy for investors looking to navigate through volatile market conditions and outperform the broader market. By combining the growth potential of small-cap stocks with the insights provided by sentiment indicators, investors can enhance their investment decisions, manage risk effectively, and capitalize on market sentiment trends to achieve superior returns.